BoJ this week lowered its real GDP forecast for FY15 and its core CPI projections for FY15-17 as part of an interim assessment of the April Outlook Report. This put the former roughly in line with consensus, while leaving the latter markedly higher. In lowering its GDP forecasts, the BoJ calmly acknowledged "some fluctuations" in the industrial production and export "pick-up," but maintained that the economy has continued (and will continue) to recover moderately with an uptrend in capex and "resilience" in private consumption.

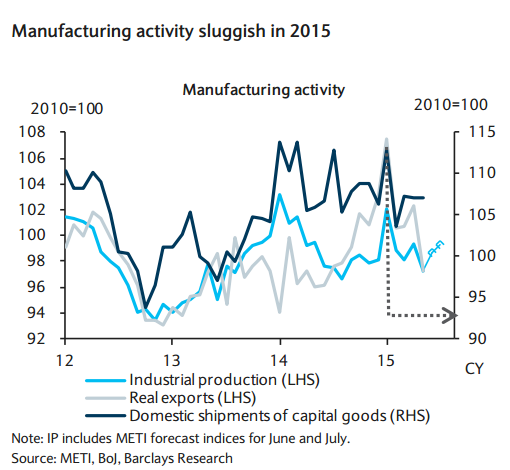

Much of the recent weakness in the economy has been on the manufacturing side. This is evident in the 2015 data on industrial production, real exports and domestic shipments of capital goods ex-transport equipment. METI forecast indices for industrial production in June and July offer some comfort, together with the sharp upward revision to FY15 capex plans in the June Tankan. Yet it remains unclear whether production capacity is insufficient enough (hard and soft data send mixed signals) or production activity is strong enough for the manufacturing sector to fuel capex.

In non-manufacturing, on the other hand, activity has been more brisk, as is evident in the uptrend in sales under Abenomics. This may actually be due less to Abenomics itself and more to coincident demographic changes - namely, the transition into retirement of Japan's first baby-boomers and the accompanying increase in demand for services. In any case, the pickup in demand has led to a labor shortage in non-manufacturing and an increased need for labor-saving capex. Taken together, the trends in manufacturing and non-manufacturing appear consistent with an outlook for a moderate uptrend in capex.

As the horizon for achieving the price stability target extends further into the future, it should be noted that the CPI rebasing to be released in August 2016 could take on more relevance. Potential effects on the CPI aside, the runup to rebasing could also highlight more fundamental issues about the suitability of the CPI target. Former BoJ Deputy Governor Nishimura, who heads the statistics commission conducting the CPI review, told Bloomberg this week that the BoJ's target may be set dangerously high because it risks lifting prices of many products too rapidly in order to offset the downward distortion in such areas as rents, which he believes could add up to 0.3pp to inflation with appropriate quality adjustments. This raises questions about whether the next move by the BoJ might also involve a reassessment of the target itself or consideration of other CPI subcomponents (ie, other than the core CPI) for reference.

Japan: Interim assessment, longer-term CPI questions

Sunday, July 19, 2015 10:38 PM UTC

Editor's Picks

- Market Data

Most Popular

7

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX