The annual Jackson Hole conference titled “Designing Resilient Monetary Policy Frameworks for the Future” scheduled to be held from 25-27 August is expected to shed some light on the future path of Fed rate hikes. The conference is primarily an academic gathering focused on cutting-edge research on monetary policy and financial developments. Discussions at the forum will focus on the Fed’s policy targets and the tools best suited to achieve those targets.

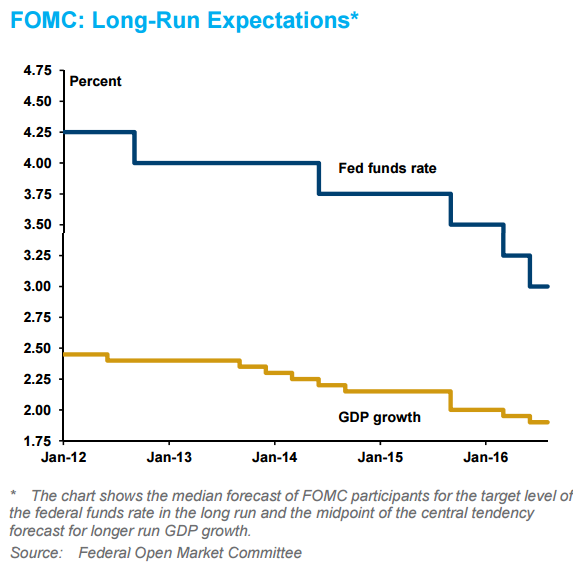

We have evidenced some Fed talk about changes to long-term strategies. San Francisco Fed's John Williams argued that the U.S. economy has changed fundamentally, and therefore, monetary policy must also change in order to be effective. Williams said neutral interest rates in the U.S have moved to a low level and since the shift in the economy could be long lasting, officials need to consider how to operate in a low-rate world.

St. Louis Fed's James Bullard has echoed similar views recently, arguing that the nature of the economy has changed. He said U.S. economy has entered a slow-growth, low-interest-rate “regime”. His comments suggest that he is rethinking economic fundamentals and would be open to new approaches from the Fed.

Minutes from the July FOMC meeting indicated that the staff presented several briefings related to possible shifts in strategy. Federal Reserve chair person Janet Yellen will speak at the annual mountain retreat meeting of central bankers on Friday, and markets will be watching closely for comments on the U.S. economy. Yellen has a great opportunity this Friday to send a clear and concise message to investors of possible changes in the future. She could use the platform to offer clues on potential changes in the Fed’s policy stance.

"If Chair Yellen were to address changes in long-run strategies, we suspect her comments would merely represent an introduction to adjustments that would be adopted well down the road. If Chair Yellen were to offer clues regarding the near term, we look for her to suggest that the Committee is still on track to proceed with policy normalization. She is likely to emphasize that the pace of adjustment will be slow, but the door to additional rate hikes is likely to remain open." said Daiwa Capital Markets in a report.

FOMC officials continue to remain hawkish over the prospects of a near-term rate hike, keeping a broad-based recovery in USD intact. Hawkish comments have pushed treasury yields across the curve higher, especially the short term ones. U.S. 2-year treasury yield is up more than 4 percent today and trading at 0.78 percent. U.S. 10-year yield is up 1.2 percent. The U.S. dollar index is up 0.3 percent, trading at 94.88. US dollar index (DXY) extends gains for a second straight session, hits high of 94.96 on the day.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices