According to latest ISM figure, US manufacturing sector activities are contracting for third consecutive month and given the weakness in capital expenditure, lower commodity prices and it could persist at least through first half of 2016.

Latest factory orders data, released yesterday pointing to similar weakness. US factory orders dropped the most in December by contracting -2.9%.

However that is unlikely to dent gains in US payrolls. Today's payroll report is expected to show that 192,000 jobs were created in the economy, which would be much lower than 292, 000 created in December but still significant enough to ensure momentum in US economy, especially the services sector.

In terms of job gains, recent weakness doesn't mean much. Weakness in manufacturing, mining and extractions are more cyclical and structural.

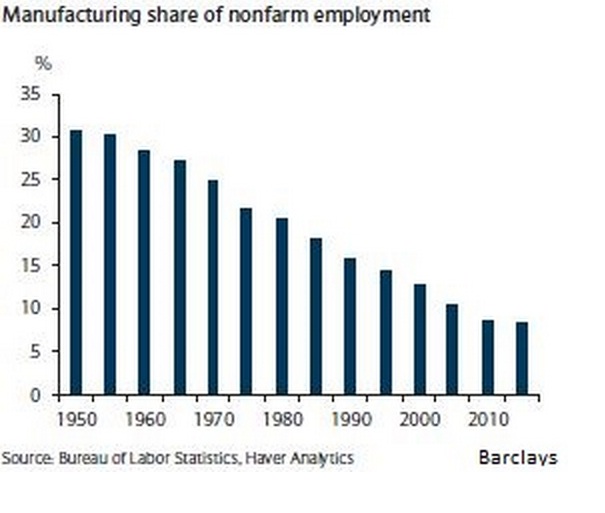

Would it have been 1950, then this weakness would have mattered a lot. Back then manufacturing used to have more than 30% share in non-farm payroll but as of 2015, according to Barclays and as shown in figure it just contributes to 8.6% in NFP and 12.1% in US GDP.

So, another blockbuster NFP could very well be on the menu.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed