The leading universal bank in the north of Germany, NORD/LB in its latest report said that the Italian economy is still not exactly in the best of the condition. The relevant sentiment indicators polled by Italy's National Institute for Statistics among companies and consumers more or less trod water in July. Above all, however, the employment situation which has hardly improved for some two years is weighing on domestic demand.

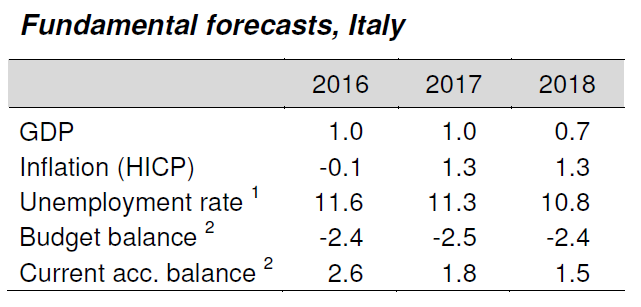

The NORD/LB bank in its economic adviser report forecast that the Italian GDP growth will be at 1 percent this year and fall to 0.7 percent in 2018. The spotlight is increasingly focussing on the political protagonists in the run-up to the parliamentary elections scheduled for spring next year, German bank noted.

Also, it added that the Harmonised Index of Consumer Prices (HICP) inflation to remain at 1.3 percent this year as well as in 2018. The unemployment rate will come at 11.3 percent this year and fall to 10.8 percent in 2018.

On the political side, the Partito Democratico is primarily preoccupied with itself as result of the power games being played by its leader Matteo Renzi, and being able to continue heading a government will certainly not be easy. In this situation, it is of all people the politically resurrected former Prime Minister Silvio Berlusconi with his Forza Italia who could be a coalition partner, the report added.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy