Undoubtedly Chinese economy has slowed down considerably in past few years, as evident from many economic dockets, such as GDP (which has slowed to 7%, slowest in more than a decade), industrial production (from double digit growth to 6% as of last month).

However there may be more than ordinary visible slowdown, and if we keep staring at industrial production and construction to recover and move again to double digit pace, we might miss the actual recovery.

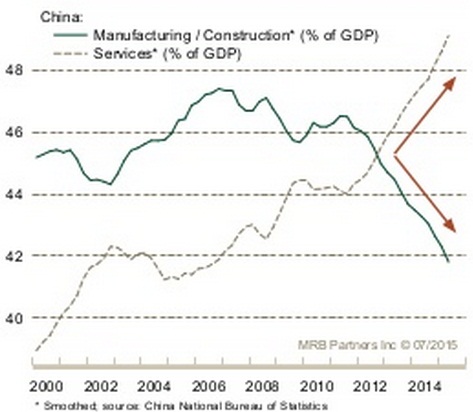

Chinese economy, as evident from the graph (chart courtesy Soberlook.com) is under major economic shift. The current has been there for quite some time now, but actually gathered pace since the crisis.

Before financial crisis of 2008/09, manufacturing and construction were contributing to more than 47% GDP and services back in 2000 were contributing less than 40% to GDP.

As of now, manufacturing and construction are contributing to less than 42% and it is likely to drop further and services are closing in to contribute almost 50% to China's total GDP.

This week PBoC attempted to improve the odds in favor of China's ailing manufacturing via three consecutive Yuan devaluation (-1.9% on Tuesday and -1.6% and -1.1% thereafter). It might improve competitive advantage for Chinese products but underlying shift is unlikely to change.

China is clearly shifting from global manufacturing hub to a service oriented economy and manufacturing is likely to play lesser role over the coming years.

So it is of high importance that we bring services indicators, which have been showing considerable strength (China services PMI in July at 53.8, highest in almost a year) into our radar along with the manufacturing ones.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings