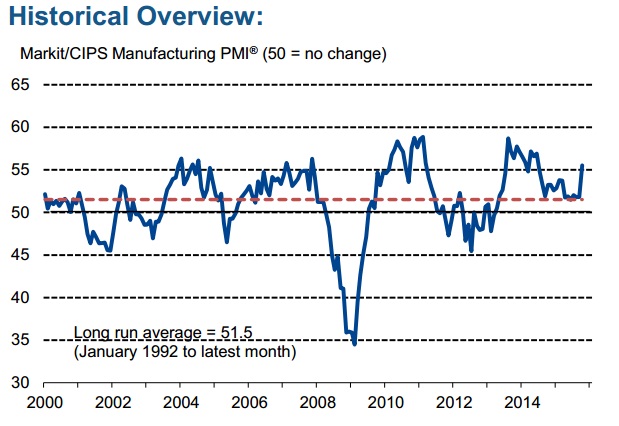

No one expected UK manufacturing PMI report to put a strong show, in fact median expectations were for marginal slowdown for headline PMI to drop to 51.3 from 51.7 in October. However, UK manufacturing PMI recovered more strongly at start of the final quarter, with headline moving up to 16 month high at 55.5.

- This sharp rebound in manufacturing, almost 3.7 points is the steepest on Markit's 24 year survey history. PMI report shows, strong growth in output as well as new orders. In both the cases pace of rise, have been sharpest since middle of last year.

- Good news is domestic market is posing strong growth accounting for majority of the new orders. Export orders rose along too, with new orders arriving from Middle East, East Asia and US.

- Expansion has been broad based, consumer, Intermediate and investment goods producers posting strong show. However, picture has not been very bright for small and medium sector.

- Employment in manufacturing rose for 13th consecutive month, according to data from Markit.

With UK manufacturing rebounding, if services and construction PMI show similar performance rate hike bets might move up. Pound will be a strong performer especially against Euro.

However only thing that remains worrying is inflation. According to latest PMI report input cost is hovering well into deflationary territory. Improvement from September's 16 year low has only been marginal in October.

Pound is currently trading at 1.547 against Dollar.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary