Hope that China has once again resorted back to its investment driven growth modeled has fuelled optimism in Steel and iron ore market. This year Chinese government has decided to use fiscal policy along with monetary stimulus to boost ailing economy.

In yesterday’s trading, steel prices in China rose 5.7% to Yuan 2708 per ton, which is highest level since September 2014. China’s overproduction has already led to an oversupply in the steel market, which is suffering some global outrage, especially after Britain’s largest steel maker Tata Steel, announced closure of operation.

China’s so called Zombie Steel mills, who wouldn’t have survived without leverage and state stimulus, are once again firing their furnaces and producing more. This sharp jump in steel prices has led to sharp increase in iron ore prices, which touched around $64/ton trading in Singapore’s SGX.

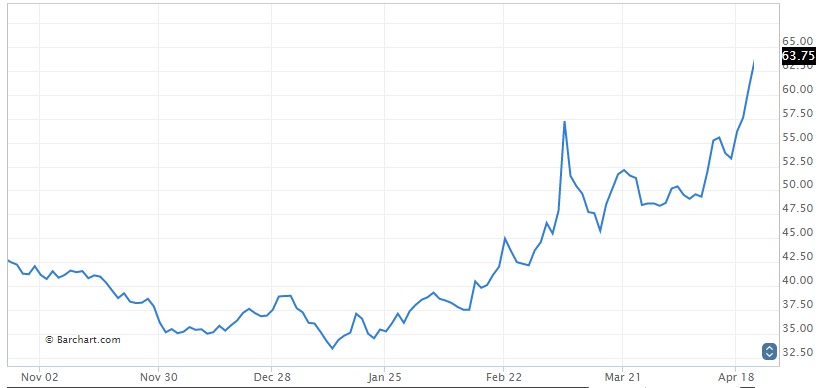

Back in December, SGX iron future for June, 2016 delivery touched $33/ton in last December, which means prices have recovered 94% since then.

Despite this electrifying rally, several investment banks, like Goldman Sachs, Barclays have warned against this rally, as it doesn’t rely on fundamentals.

Even world’s top miner BHP Billiton has also warned that this rally will not be sustainable.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX