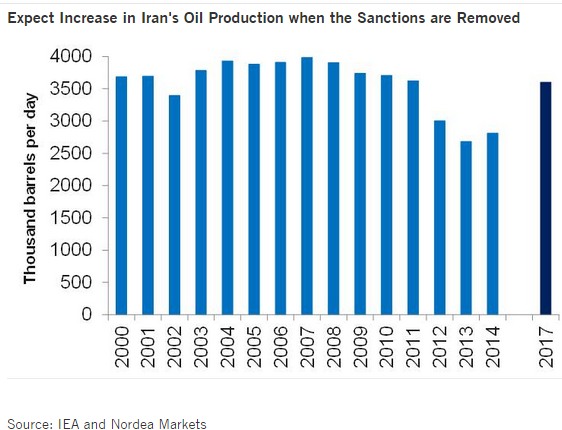

The removal of the sanctions means that Iran will again be able to ramp up production to full capacity, that is, increase output by 800k b/d.

"We don't expect to see production at full capacity before late 2016 as the UN sanctions will be lifted gradually and the US Congress will need 60 days to review the deal. Details of the deal are still uncertain, but the oil market will focus on the crucial timing and scope of sanctions relief for Iran," says Nordea Global Research.

Apart from production, Iran could immediately impact the oil market once sanctions are lifted as it has stored a large volume of oil on its idle tanker fleet. The volume most reported by tanker tracking specialists is 30m barrels though some quote even 45m barrels.

Basically, the return of Iranian oil will postpone the point in time when the oil market will balance from mid-2016 to 2017/18. In June OPEC was producing 1.71m b/d above its production quota, and in Q2 and in Q2 the oil supply exceeded oil demand by on average 3.3m b/d.

Iran's Oil production expected to ramp up to full capacity

Tuesday, July 14, 2015 8:42 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX