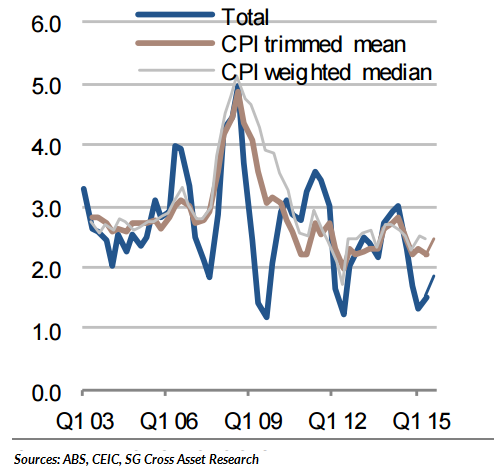

Australia's consumer price data for the third quarter, due on Wednesday at 00:30 GMT, is expected to print in line with the Reserve Bank Australia's CPI forecast. Data is expected to point to a gradual increase in price pressures, but there is a little risk of underlying inflation breaking out of the RBA's 2-3% target band. Despite an expectation for some pass-through to consumer goods from the weaker Australian dollar, it is unlikely to have any impact on consumers' inflationary expectations.

Several factors point to an increase in the headline and core inflation rates, which are expected to overwhelm the impact of slightly weaker energy prices. A sizable impact on annual inflation rates will come from the repeal of the carbon tax in July 2014, which will cut around 0.4pp out of the y/y rate and add to the headline rate. A 12.5% hike in the tobacco excise rate on 1 September will also have an inflation-boosting effect.

"Because of the swings in energy prices the seasonally adjusted index is expected to have risen 0.5% qoq after 0.8% in Q2, but given a positive seasonal factor in Q3 we expect a 0.8% qoq gain in unadjusted terms, after 0.7% in Q2. This would lift the headline inflation rate by 0.4pp to 1.9%, so still just below the official target range. Core measures are expected to have risen a little more quickly than in Q2, by an average of 2.5% yoy after 2.3% in Q2 (0.6% qoq)", notes Societe Generale in a research note.

With inflation subdued, and still within the RBA's target, monetary policy will likely be driven more by real activity outcomes and financial conditions. With underlying inflation likely in the middle of the target range both year-on-year as well as quarterly annualised terms, RBA would have no reason to adjust policy, but at the same time, it would not be an obstacle for a move in either direction.

Although the Fed stayed on the sidelines in September, there is every possibility for a rate hike before the end of the year. Monetary policy divergence between the Fed and RBA clearly favors the USD, and the Australian economy continues to struggle with weaker demand from China, Australia's largest trade partner. So, the overall sentiment is bearish on AUD/USD towards this release.

CPI inflation data is typically a significant market mover. Wednesday's result is very much likely to be right on track and thus not expected to swing the market. However, an unexpected reading release can have a significant impact on the direction of AUD/USD. CPI for Q2 came in at 0.7%, the highest gain since Q4 of 2013. The estimate for Q3 stands at 0.7%.

Antipodeans drifted sideways on Tuesday with investors reluctant to take big bets ahead central bank meetings in the United States and Japan. The Aussie was sold-off during the Asian session as substantial risk aversion gripped markets. The pair is currently trading at 0.7242 (at 1020 GMT), with immediate resistance at 0.7249 (10 DMA) and support at 0.7211 (20 DMA).

Inflation momentum in Australia gradually picking up

Tuesday, October 27, 2015 10:46 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?