The 5y5y EUR inflation rate (what we've been calling "the Draghinometer", since the ECB President began to focus heavily on it) now sits at 1.64%. That, in itself, will be somewhat troubling for the ECB, although the US market prices a similar long-term policy target shortfall if you allow for a prospective "wedge" between the targeted PCE measure of inflation and the CPI measure used by the inflation market.

"It is the near-term inflation forwards that are more alarming for the ECB, even though they have firmed lately. The 1y rate (ie, inflation in July 2016) is at 0.46%, the 1y1y at 0.71% and the 2y3y at 1.11%", says Bank of America.

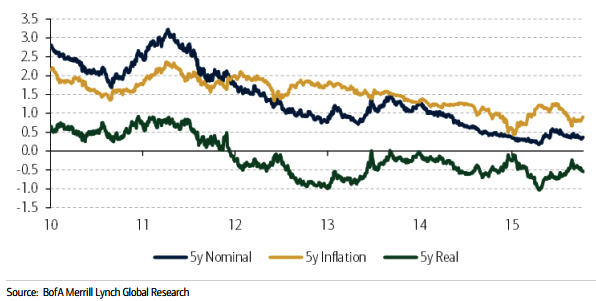

These rates are well below the ECB's own forecasts, needless to say, and somewhat lower than our own, although the market prices inflation being well below target for a long time, it also prices nominal and real policy rates beginning to rise.

Real policy rates are regarded as the true measure of monetary policy tightness and they are rising from about two years out, The 5-year real swap rates achieved a post-QE low of -1%.

Even that rate was no lower than levels seen back in 2013 and was somewhat higher than the real rates seen post-QE in the US and UK. So, the rise in real rates since then (now -55bp at the 5-year point) must be as concerning to the ECB as the stubbornly low breakevens, since lowering real rates is seen as a key transmission channel for QE.

Inflation markets probably unimpressed with ECB QE so far

Tuesday, October 13, 2015 5:18 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX