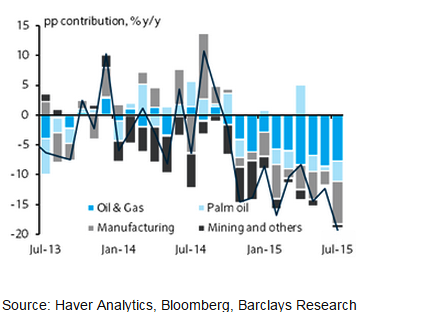

Indonesia's trade surplus surged to USD1.3bn in July, with weaker exports at -19.2% y/y more than offset by a -28.4% plunge in imports. The lack of government spending (until mid-April) has had significant spillover effects to the economy, resulting in reduced employment, private consumption and imports.

President Jokowi's recent cabinet reshuffle would help in speeding up investment spending and this is expected to be a bigger growth driver in H2. The fall in imports was partly seasonal in the aftermath of Ramadan, but consumer sentiment remains on the weak side, as seen in the continued relatively low levels of motorcycle sales.

The release today brought the YTD trade surplus to USD5.7bn, the highest since 2011. The improvement masks a slightly concerning underlying trend, which is a steadily weaker ability to consume imported durables, now that the IDR is 15.7% weaker vs the USD than a year ago. Another factor was the delayed launch of key infrastructure projects and the delays in awarding government tenders.

According to Barclays,

Indonesia's manufacturing likely to improve in coming months

Tuesday, August 18, 2015 6:18 AM UTC

Editor's Picks

- Market Data

Most Popular

2

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX