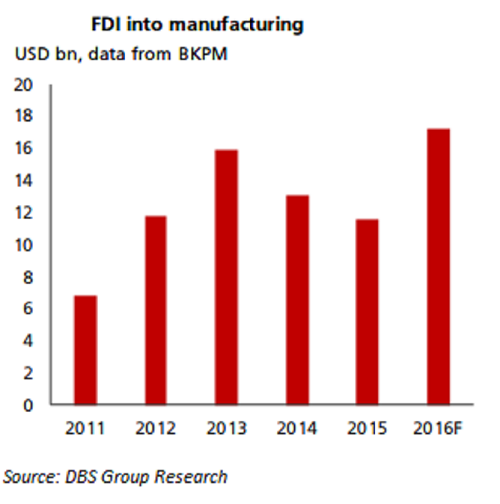

Foreign direct investment in Indonesia’s manufacturing is expected to reach a record-high of USD17 billion this year, with the overall FDI already having gone up, excluding that in the area of mining. If FDI can be maintained at 2 percent of GDP, the current account deficit appears sustainable.

Foreign direct investment (FDI) rose to USD 6 billion in 3Q, well above the USD 3.8bn average of the first half of the year. Still, FDI this year is likely to come in circa USD 19 billion, 6 percent lower than in 2015 and the lowest figure since 2011, DBS reported.

While the headline figure is disconcerting, the picture is brighter under the hood. While mining has consistently attracted the greatest amount of FDI in recent years, the top destination for FDI is now machinery and electronics.

Other sectors, such as paper / printing, pharma and the auto industries have now attracted more investors compared to the mining industry. Excluding mining, FDI is likely to grow by about 5 percent this year. FDI into manufacturing is set to reach a record-high USD 17 billion, the report added.

On a net basis, FDI has risen to 2.1 percent of GDP in 3Q, well above the 1.2 percent recorded in 1H16. This broadly equals the average current account (C/A) deficit over the past two years. Back in mid-2013, Indonesia’s C/A deficit of 3.5 percent of GDP appeared unsustainable as only half of it was covered by net FDI.

Meanwhile, the USD/IDR currency pair remained highly bullish, closing at 13,563, up 0.28 percent.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens