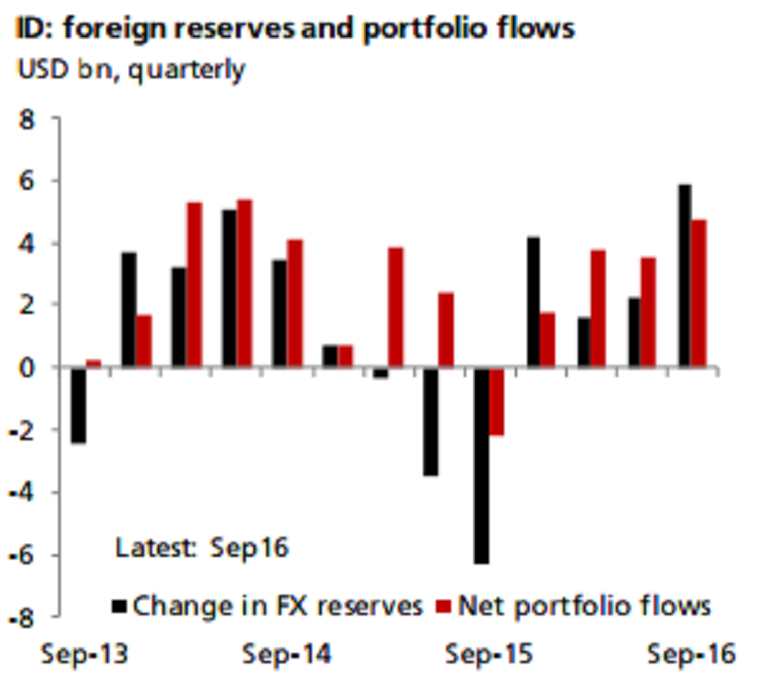

Foreign reserves in Indonesia surged to more than a four-year high during the month of September s having risen by close to USD10 billion. This is equal to about 80 percent of total foreign inflows recorded in equities and Indonesian government bonds.

Bank Indonesia (BI) officials have reiterated that the central bank prefers to avoid excessive rupiah strength. Going by the foreign reserves number, it is clear that the central bank has been active smoothing flows in the markets.

Moreover, building up reserves is also important to shore up the macro risk profile, amid lingering uncertainties in global markets. Admittedly, risk of a selloff similar to the mid-2013 episode is no longer as significant now that markets are increasingly getting used to the idea of an eventual and gradual tightening by the Fed, DBS reported.

Still, Indonesia’s external liquidity front remains among the most vulnerable in the region. While current account (C/A) deficit has narrowed to about 2 percent of the country’s gross domestic product (GDP), net foreign direct investment has also moderated to about 1.2 percent of GDP. Portfolio flows still finance quite a big chunk of the C/A deficit.

It is important to note, however, that BI is no longer tolerant of a weak rupiah (relative to its regional peers). This previous stance never quite made sense, given that the economy is a price-taker for most commodities, which are important for the overall export growth. Besides, the real challenge to prop up GDP growth now is the weaker-than-expected private investment growth. Arguably, with significant import content in the economy, a stronger rupiah could even boost growth momentum ahead, the report added.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions