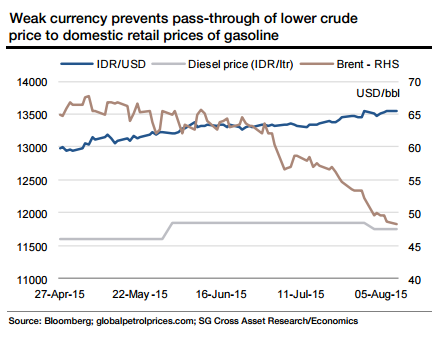

The IDR crossed the 13,500 mark vs the USD in August 2015, flirting with its 17-year low when the Asian crisis was upon us. While oil prices remaining weak implies lower revenue from the oil and gas sector, domestic retail prices of motor fuel have actually gone up, despite falling crude prices, as the currency continued to weaken and revenue concerns came to the fore. It is only recently, in early August 2015, that retail prices have fallen a tad after crude prices declined by a quarter from their June 2015 peak.

Not surprisingly, Indonesia has not even benefited from weak crude prices on the inflation front, despite being a net oil importer. At 7.26%, Indonesia's CPI inflation is at a 15-month high, which is well above the BI's comfort level of 5%. With a weak currency and a real policy rate that is barely positive, the BI is not in a position to cut the policy rate to prop up the economy. The currency will come under more pressure with the impending Fed rate hike and the recent devaluation of CNY. The government is not helping the cause either, as reforms remain slow and there's no perceptible shift towards manufacturing for an economy that is heavily dependent on commodities and hence exposed to the vagaries of the commodity cycle.

Indonesia: Weak currency and weaker commodity prices, major headwinds

Tuesday, August 11, 2015 9:04 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed