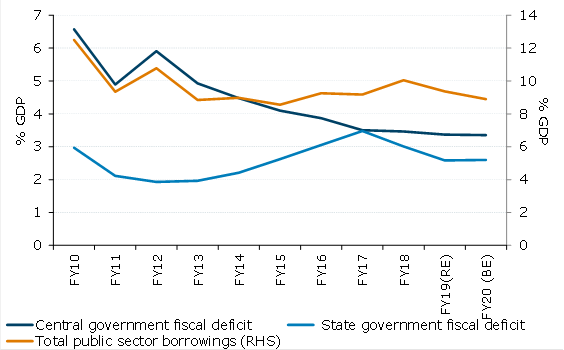

The inability of bond yields to break lower despite an unprecedented scale of liquidity infusion by the Reserve Bank of India (RBI) and expectations of further monetary easing is explained by the worsening fiscal position, according to the latest report from ANZ Research.

The government has now deviated from the fiscal roadmap in four of its five years in tenure. The medium term fiscal deficit target of 3 percent of GDP, initially to be achieved in FY17 (fiscal year ending March 2017) has been pushed out to FY21 (fiscal year ending March 2021).

Higher off-budget funding of public capital spending has also under-stated the real extent of India’s fiscal deficit. The management of the disinvestment process has also shifted from initial public offerings to the public to private placements with state-owned insurance companies and share buybacks by state enterprises, the report added.

At the current run rate, the combined central-state government debt ratio of 60 percent can be attained by the revised timeline of FY25 as laid out in the fiscal roadmap. This is however, sensitive to the underlying assumptions, especially nominal GDP growth.

"The current accommodative fiscal-monetary mix has not filtered through to the currency market as yet. The closure of the output gap, which will also result in a widening of the current account deficit, could well be the inflexion point," ANZ Research further commented.

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens