The performance of India’s service sector drastically deteriorated in November as a result of cash shortages. New business declined for the first time since June 2015, leading to a solid reduction in activity.

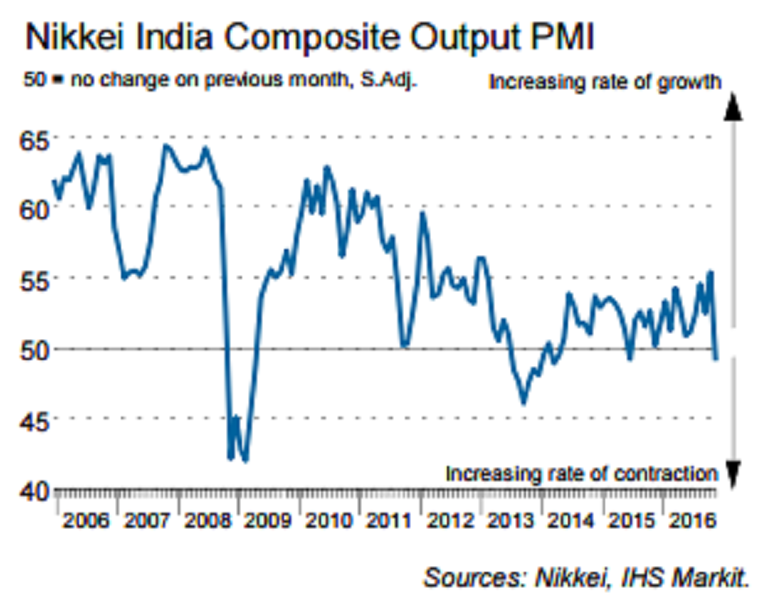

The seasonally adjusted Nikkei India Composite PMI Output Index dipped from October’s 45-month high of 55.4 to 49.1 in November, thereby pointing to a slight contraction in private sector activity overall. Dropping from 54.5 to 46.7 in November, the seasonally adjusted headline Nikkei India Services Business Activity Index registered in contraction territory for the first time since June 2015 and pointed to the sharpest reduction in output for almost three years.

Service providers recorded higher levels of outstanding business in November, which they commonly associated with delayed payments from clients. Backlogs rose for the sixth straight month, but at the slowest rate since July.

Although the scarcity of rupee notes also weighed on manufacturing performance, new order growth was sustained. The rise was, however, insufficient to offset the downturn in services and new business across the private sector as a whole decreased slightly.

Further, input costs in the Indian service sector were broadly unchanged in November as falling prices for petrol and raw materials acted to offset higher staff salaries. The respective index dropped to a three-month low and was close to the crucial threshold of 50.0. Indian service providers expect activity to rise over the next 12 months, with the degree of optimism signalled in November being the highest since August.

"The disruption is expected to be short-lived; on a positive note, the reduction in money supply curbed inflation in November. In light of these numbers, further cuts to the benchmark rate are expected," said Pollyanna De Lima, economist, IHS Markit.

Meanwhile, USD/INR currency pair has formed a bullish reversal pattern, after four successive downward bearish candlestick patterns at 68.22, up 0.28 percent. The Sensex traded flat at 26,243, while Nifty-50 futures traded 0.28 percent higher or 23 points at 8,131 by 07:30 GMT.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals