The Indian sovereign bonds plunged Thursday after the Federal Reserve increased interest rates for the first time in 2016 and hinted at a faster hike in borrowing costs next year, majorly driven by increased inflation expectations and labour market tightening.

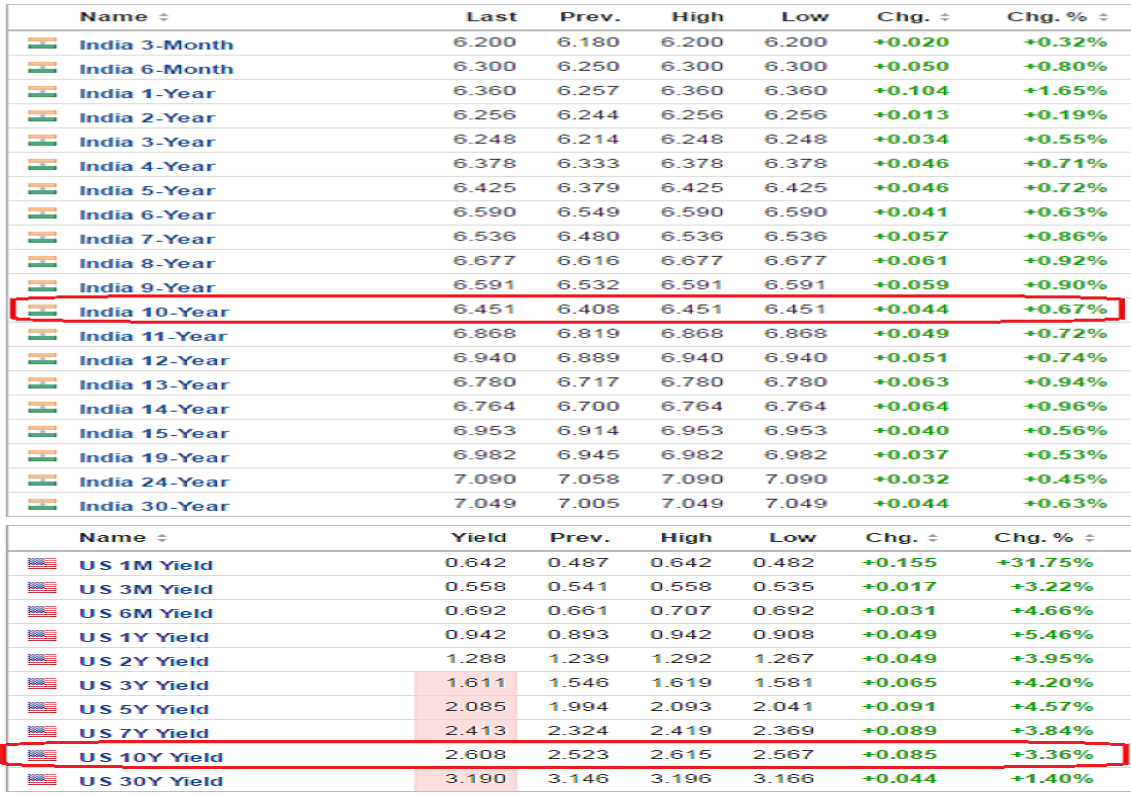

The yield on the benchmark 10-year bonds, which moves inversely to its price, rose 4-1/2 basis points to 6.45 percent, the long-term 30-year bond yield climbed 4 basis points to 7.04 percent and the yield on short-term 2-year note bounced 1-1/2 basis points to 6.25 percent by 07:10 GMT.

The Indian bonds have been closely following developments in the U.S. debt market. The benchmark 10-year bonds witnessed a heavy sell-off, pushing yields by 8-1/2 basis points to 2.60 percent (highest since September 2014).

The Federal Open Market Committee increased the fed funds rate to a 0.50-0.75 percent range, as widely expected. The statement noted that information received since the November meeting indicates that the labour market has continued to strengthen and that economic activity has been expanding at a moderate pace since mid-year.

Also, the new projections showed that the central bankers expect three quarter-point rate increases in 2017, up from the two seen in the previous forecasts in September, based on median estimates.

Moreover, India’s wholesale price inflation fell during the month of November, at the slowest pace in five months. However, it came in higher than what market participants had priced in initially.

India's wholesale prices rose 3.15 percent year-on-year in November, its slowest pace in five months, data released by the Indian Ministry of Commerce and Industry showed Wednesday. The data compared with a 3.10 percent annual rise forecast by economists in a Reuters poll.

On Tuesday, India’s consumer price inflation slowed to 3.63 percent y/y in November, from 4.20 percent in October. This comes lower than the market consensus of 3.90 percent y/y. The downward surprise was mainly because of fruits and vegetables.

Last week, the Reserve Bank of India (RBI) kept the benchmark repo rate unchanged at the two-day bi-monthly policy decision based on an overall assessment of the macroeconomic conditions, with an objective of achieving stable consumer price inflation.

The RBI’s Monetary Policy Committee (MPC) decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.25 percent. Consequently, the reverse repo rate under the LAF remains unchanged at 5.75 percent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

The decision of the MPC remains consistent with the objective of achieving consumer price index (CPI) inflation at 5 percent by Q4 of 2016-17, while maintaining a medium-term target of 4 percent within a band of +/- 2 percent, while supporting growth.

Meanwhile, the benchmark 30-share Sensex is down 0.02 percent to 26,598, while 50-share Nifty slid 0.05 percent to 8,200 at 7:30 GMT.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed