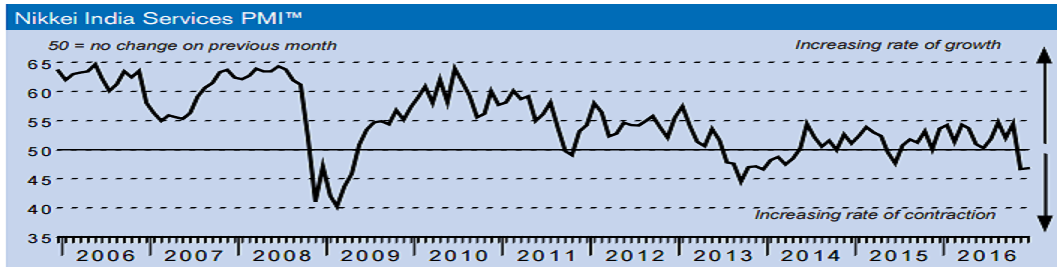

Performance of services sector in the Indian economy deteriorated during the month of December, following a short-term crisis-like situation due to the demonetization policy imposed by Prime Minister Narendra Modi with effect from November 8, 2016 midnight.

The seasonally adjusted headline Nikkei India Services Business Activity Index registered 46.8 in December, little-changed from November’s reading of 46.7 and indicating a further solid contraction in output. Moreover, the downturn was broad-based by sub-sector, with Hotels & Restaurants firms the worst performers.

Cash flow issues reportedly caused another increase in outstanding business volumes. Backlogs decreased for the seventh straight month in December, although only moderately. In spite of higher backlogs, service providers made cutbacks to staffing levels during December. That said, the drop in employment was only fractional, thereby continuing a trend of broadly stagnant workforces that was evident throughout 2016.

Input prices faced by service providers in India continued to rise in December. However, with less than 1 percent of firms indicating higher cost burdens and the remaining respondents signalling no change since November, the rate of cost inflation was only marginal and negligible in the context of historical data.

On the other hand, output prices were lowered for the third successive month amid intense competitive pressures and attempts to stimulate demand. Nevertheless, the rate of discounting was marginal overall.

Indian service providers signalled optimism regarding the 12-month outlook for activity during December, although the level of positive sentiment dipped to the third-lowest in over 11 years of data collection.

Meanwhile, USD/INR traded at 68.18, up 0.08 percent; at 6:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at 22.56 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk