India's Chief Economic Advisor Arvind Subramanian, has cited a sustained deflationary trend in WPI to justify the call. While a deflationary trend in an inflation gauge does indeed merit a call for a rate cut, a question remains about the relevance of WPI itself.

Following the seventh straight month of deflation in WPI (and third straight month of contraction in core WPI), those in favour of further policy rate cuts have been pointing tothis indicator to drive home their point. There are, however, certain fallacies in this argument.

With 2004- 05 as a base year and components that may not be relevant, WPI is in need of an immediate revamp, especially as both India's GDP and CPI have undergone revision, says Societe Generale.

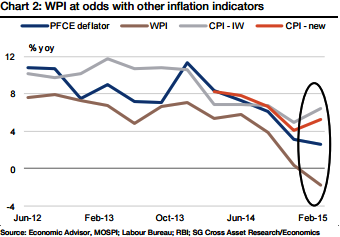

The national CPI has been following a different trajectory altogether and not in sync with the deflationary trend of WPI. Even if one considers the deflator of the private expenditure component of GDP, also known as PFCE (Private Final Consumption Expenditure), the WPI trajectory appears to be at odds.

India not in deflation, as suggested by WPI

Wednesday, July 1, 2015 3:52 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX