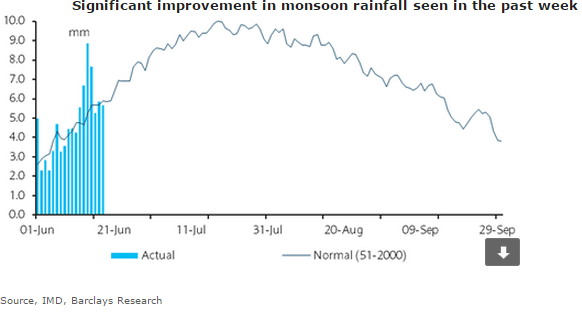

The south-west monsoons showed dramatic progress in the last week, with improvements in quantity and geographic distribution of rainfall. Cumulatively, rainfall conditions have moved into a small surplus, with the total rainfall between 1 June and 18 June 10% above normal.

Geographic distribution has improved significantly, with 23 out of 36 regions showing excess or normal rainfall conditions, up from 18 last week. The regions showing scanty rainfall (60% below normal) has shrunk significantly, dropping to 4 from 10. While these are early trends, the fears around subpar monsoons have eased.

The Indian Meteorological Department (IMD) has indicated that rainfall conditions in the 2015 season may be better than its current projection of 88% of the long-period average given the early trends. While this is encouraging, the government still appears better prepared to deal with any contingency, and has made plans covering 600 out of 676 districts for drought relief.

The focus on controlling inflation persists, and in its announcement of minimum support prices on 17 June, the government kept the price increases low for cereals, and only increased it substantially for pulses, in order to encourage production and sowing. The new MSPs will come into effect from October 2015.

The Reserve Bank of India (RBI) in its recent statement noted that monsoon-related risks dominate its concerns around inflation. Food prices have risen in early June, perhaps in response to fears of a poor monsoon season. Pulses, especially, have seen a sharp increase in May-June. While headline inflation remains manageable in India, risks around food inflation persist, and in that context, the lack of increase in MSPs for the summer crops is a welcome sign.

"We forecast FY 15-16 average CPI inflation of 5% (H1 FY 15-16: 4.5%, H2 FY 15-16: 5.5%, 13 March 2015). We expect monetary policy in the coming months to continue to be data-dependent. Despite the cautious guidance recently from RBI, the risk of another cut in H2 FY 15 remains, in our view",says Barclays.

However, such action will remain contingent on greater clarity on a number of factors, including trends in commodity prices, the monsoon outcome, the likely 2016 inflation trajectory and the impact of a Fed rate hike, potentially in H2 15.

India monsoon tracker: A good week

Friday, June 19, 2015 2:29 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022