India’s November industrial production grew at the fastest pace in 2016, shrugging-off all belying expectations of demonetisation. This robust growth was expected on favourable base effects and Diwali festivities but the improvement was sharper than the market consensus.

November industrial production jumped 5.7 percent y/y reversing from October’s -1.8 percent. Manufacturing output rose 5.5 percent y/y along with firm electricity generation and mining output.

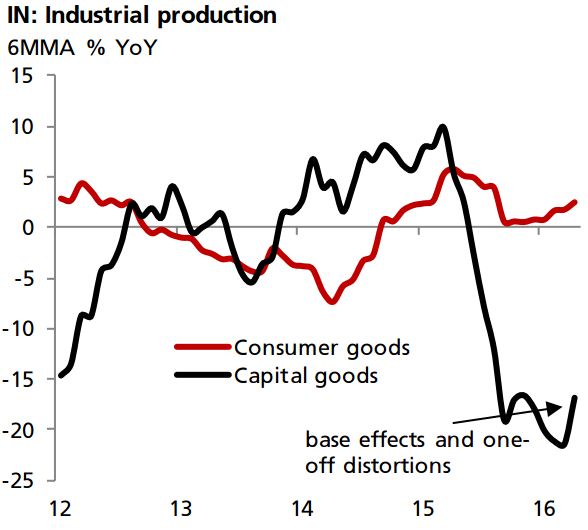

On the use-based end, capital goods jumped 15 percent y/y after 12 consecutive months of negative prints (average -20 percent y/y). But this is unlikely to trigger much optimism on investment growth as a sharp 185 percent rise in cable, rubber insulated component continues to distort underlying trends, reported DBS Group Research

Consumer durables output moderated on sequential terms due to the cash crunch. Along with still weak investment trends, other high-frequency signal slower momentum in November/December 2016.

This suggests that the phase of subdued production growth is likely to extend into December, 2016/January 2017, no helped the least due to a build-up in inventories and weak demand due to the recent cash crunch, they added.

Meanwhile, the 30-share benchmark Sensex traded 0.11 percent lower at 27,210.84, while the 50-share benchmark Nifty futures traded 0.31 percent or 25.95 points lower at 8,380.60 by 08:15 GMT.

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed