Just as oil and gas has raised the stature of countries like Saudi Arabia in the age of oil, countries that dominate the production of metals are set to benefit similarly in the rare metal age.

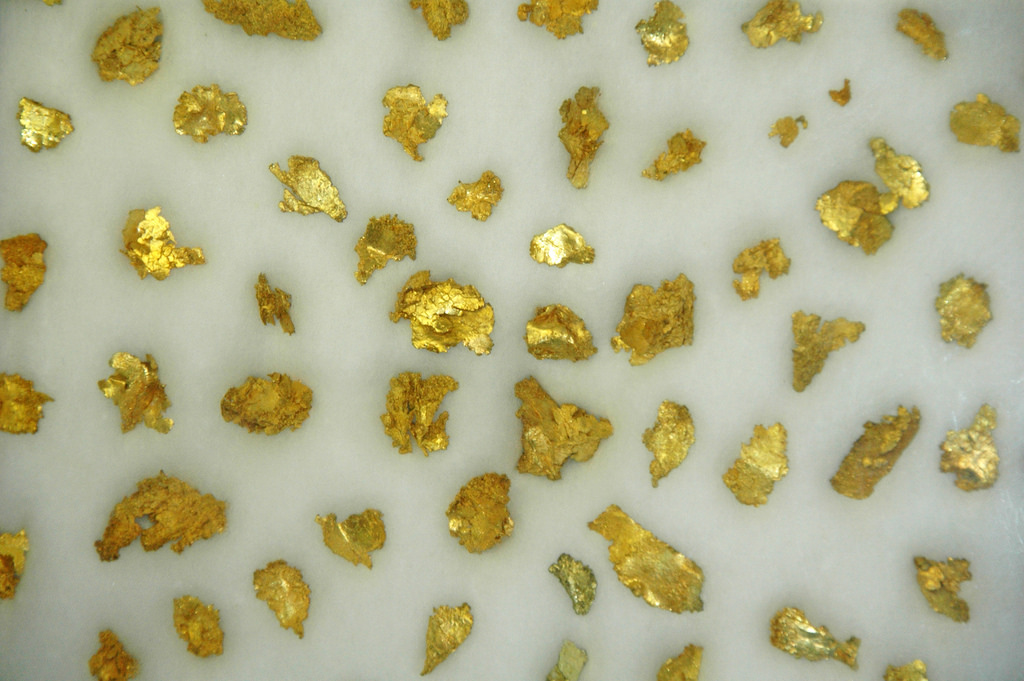

Rare metals, which are produced in limited amounts and often in just a few countries, play critical roles in the next generation of products: they store power, provide luminescence and make products more efficient. Tesla vehicles, iPhones, Boeing 787s and even night vision goggles rely on the specific properties of a host of difficult-to-pronounce obscure metals.

Because of the global explosion in high-tech wizardry, people rely on the production of more metals on the periodic table than ever before. And because of the high number of rare metals it takes to produce green products, it’s no understatement to say that the fate of the planet is tied to these materials.

Over the Olympic season, countries rank their international stature on medal counts achieved during the games as a proxy for a country’s geopolitical stature. But the “real metal count” has a greater impact on the fate of nations.

To give an idea of how countries are doing, we produced two infographics to show the most notable changes in global producers from 1970 and 2015. It tallies the first, second, and third leading producers of all major and minor technology metals.

From the metal tables you can see that no country has succeeded in the real metal race like China. Through geological good fortune, along with a sustained focus on the production of rare metals at lower costs than other countries, China is poised to reap the gains from their production. Their focus on producing these metals is important. Finding secure, stable supplies outside China is a goal of two international research projects, SoS Rare and HiTech AlkCarb.

Unlike Saudi Arabia, which sought riches from the sale of its resources, China seeks to capitalise on building downstream industries – for example, by making smartphones using home-produced components – through its industrial strategy: Made in China 2025. These resources are then a great means to continue to expand their manufacturing prowess.

David Abraham, senior fellow at New America, assisted in the production of the piece.

Dylan McFarlane receives funding from the European Union's Horizon 2020 research and innovation programme under grant agreement 689909 for the HiTech AlkCarb project, a research project to develop new geomodels and sustainable exploration methods to target critical raw materials within alkaline igneous rocks and carbonatites.

Dylan McFarlane receives funding from the European Union's Horizon 2020 research and innovation programme under grant agreement 689909 for the HiTech AlkCarb project, a research project to develop new geomodels and sustainable exploration methods to target critical raw materials within alkaline igneous rocks and carbonatites.

Robert Pell receives funding from NERC and the University of Exeter for the SoSRare project, a research project aiming to understand the mobility and concentration of rare earths in natural systems, and to investigate new processes that will lower the environmental impact of rare earth extraction and recovery.

This article was originally published on The Conversation. Read the original article.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings