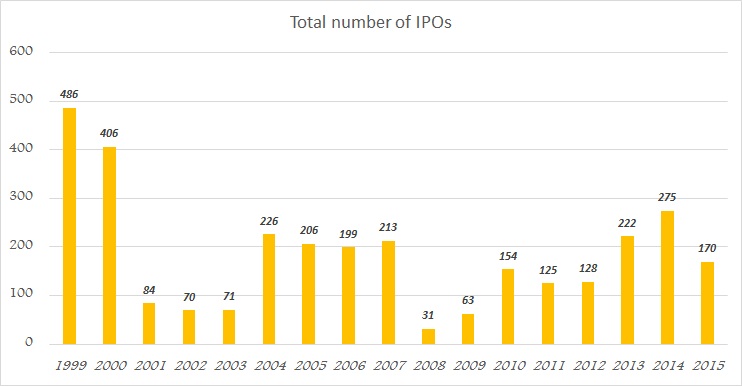

With rate hike from US Federal Reserve looming, investors just couldn't get their mojo back after August financial market turmoil, post Yuan devaluation. Number IPOs (IPOs are initial public offering, when companies float equities and get listed) launched is US this year has shrank considerably compared to prior years. By one measure 2015 is proving to be worst since 2008/09 financial crisis.

Number of IPOs this year so far has been 170, almost 40% down from 2014 and worst since 2012.

IPOs are crucial for smooth functioning of financial market, since angel & private equity investors, venture capitalists try to get back their return from this public float. These investors are crucial for early stages of any company looking to finance their business.

In terms of value it has been worst. Total value booked so far stands at $28.7 billion, 48% lower compared to 2014 and worst since 2007.

Due to market turmoil, contagion from lower oil price and cautious investors', prices have been revised lower in most of the launch and many have been shelved. Pipeline suggests, 2016 could be no better.

In December so far, there has been launch of only two IPOs, worst since December of 2008, when there was no IPO launch.

IPOs are good indicator for market sentiment and it clearly suggests, sentiment is in decline.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX