The IMF in its latest "World Economic Outlook" released on Tuesday revised its projections for Brazil sharply downward from a 1-per cent contraction to a-3.5 per cent contraction this year. This is a significant change and comes ahead a critical Brazil Central Bank decision on Wednesday over whether to raise interest rates to fight the country's high inflation.

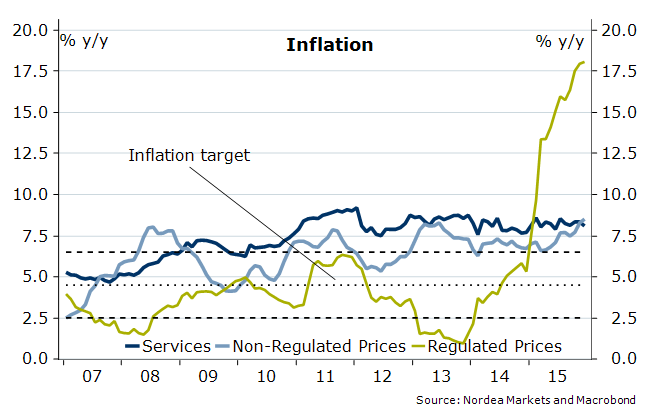

Brazil's inflation ended 2015 significantly above the 4.5% mid-point target at 10.7%, and the inflation outlook and the balance of risks to inflation remain challenging. The BCB targets to bring inflation to 4.5% in 2017 and the likelihood of inflation to reach the target without additional tightening looks small.

Political uncertainty and corruption scandal in state oil firm Petrobras has weighed on the economy, Brazil's fell into recession in the second quarter of last year. Ripple effects are likely to be felt across all the Latin American and the Caribbean countries, whose economies are predicted to drop by 0.3 per cent this year and rise by 1.6 per cent in 2017, according to the IMF.

Fitch ratings agency ruled out a rapid recovery of Brazil's investment grade rating noting that Brazil's recession would be "deeper and longer" than predicted. According to Fitch, the Brazilian economy will contract by 2.5 per cent this year due to "continued weaknesses."

Central bank chief Alexandre Tombini's comments hours before the start of a two-day monetary policy meeting considerably lowered expectations for the bank to hike its benchmark Selic interest rate. Tombini said policymakers will take into consideration the International Monetary Fund's "significant" cuts to Brazil's growth outlook for this year and 2017.

USD/BRL is edging higher as we write, with a sudden spike from 4.05 levels to currently trade at 4.0943.

IMF's revised projections to influence BCB rate hike decision

Wednesday, January 20, 2016 11:11 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?