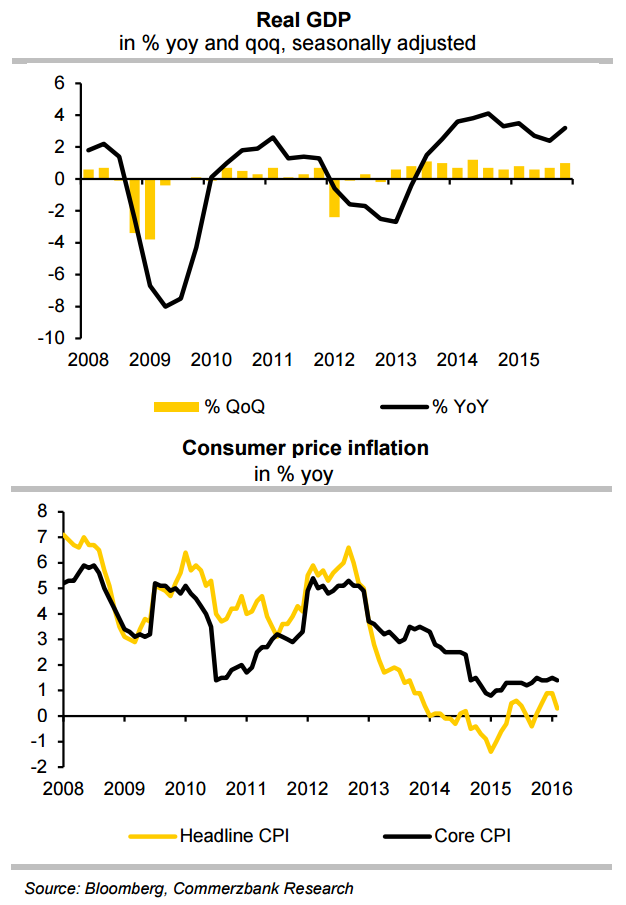

Data released last week showed that Hungarian CPI re-entered deflation in March, with headline CPI falling by -0.2% y/y. All underlying inflation measures calculated by MNB also dipped, with the main one – core inflation net of tax changes – dropping to +1% from a steady 1.1%-1.3% during the past several months. Without a sudden increase of oil prices, inflation is expected to fall further in the coming months below -0.5% and it is likely to remain in negative territory till August.

Hungary's inflation outlook is far more benign than in recent years and the central bank (MNB) has recently lowered its projections – 2016 headline inflation from 1.7% to 0.3% and 2016 core inflation from 2.4% to 1.7%. The 2016 projections are now dovish enough, but downside risk exists for 2017 forecasts where MNB expects inflation to noticeably accelerate again, e.g. core inflation is forecast at 2.4% for 2017. We would need to witness inflation pressure picking up across Europe soon for such forecasts to be fulfilled – but so far, global demand conditions do not point in the direction of such a pick up.

Growth in Hungary is also slowing down. After growing by a solid 3% in 2015, momentum is expected to decelerate this year. The PMI has already pulled back sharply towards 50 over the past couple of months. Commerzbank forecasts a GDP growth of 2.2% during 2016.

The National Bank of Hungary has re-opened the rate cutting cycle after a pause and further easing is on the cards. The MNB cut its overnight deposit rate by 15 basis points to -0.05 percent at March meeting and lowered its overnight lending rate to 1.45 percent from 2.1 percent. The bank also cut its key base rate by 15 basis points to 1.2 percent despite market expectations for no change. MNB is also expected to enlarge its QE programme further during the year. Rate cuts are expected to weaken the forint from current levels. EUR/HUF was trading around 311.97, while USD/HUF was at 273.53 at 1140 GMT on Monday.

"We forecast the benchmark rate to drop to 0.75% before year-end. Over the coming year we expect the currency to depreciate as we forecast further monetary easing. We now expect EUR-HUF to reach 320.00 instead of 325.00 by end-2016, then remain steady at that level through 2017." said Commerzbank in a research note.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate