Westpac Research notes:

In June the RBNZ reduced the OCR by 25 basis points and signalled that a follow-up cut would come at some point later in the year. The RBNZ was concerned that underlying inflation had drifted too low. Because the economy's capacity to supply goods and services was greater than previously thought, there was little upward pressure on inflation in the pipeline. And with dairy export prices falling fast, the RBNZ saw a risk of an economic slowdown that could further reduce inflation pressures. The RBNZ was dismissive of the possibility that rapidly rising house prices could stoke future inflation.

The June cut surprised financial markets. We suspect that the RBNZ chose to surprise financial markets in order to put downward pressure on the exchange rate, which is a rapid way of provoking higher inflation.

The one development that genuinely does argue against interest rate cuts is the plunging exchange rate. However, we suspect the exchange rate has not fallen far enough - the RBNZ still has a lot of work to do to return inflation to two percent on average over the medium term. The final significant piece of context for the OCR outlook is comments that were made by the Minister of Finance about a week after the June MPS.

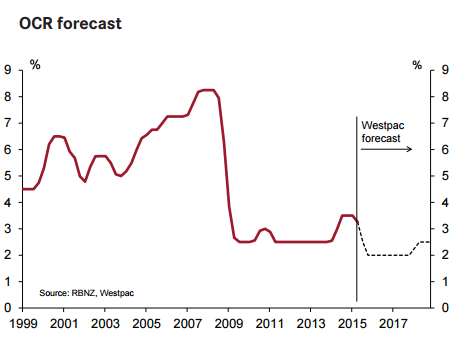

With all of the above in mind, it now seems abundantly clear that the RBNZ will reduce the OCR further and faster than it signalled in the June Monetary Policy Statement. We now expect the OCR to fall to 2.0% by the end of this year. There are better than even odds of a 50bps cut at some point during the year. For Thursday, an OCR cut of some description is a slam dunk. Our base case is that the RBNZ will cut 25bps and will use strong language to describe the likelihood of further OCR cuts.

An OCR Review along these lines would cause markets to price some risk of a 50bps OCR cut in September, and to price a risk of the OCR eventually falling below 2.5%. These market changes would manifest as a drop in the two-year swap rate on the day. Lower swap rates, combined with language aimed directly at the exchange rate, would also see the exchange rate fall on the day.

There is a clear risk that instead of waiting, the RBNZ will cut 50bps on Thursday. We see valid arguments in favour of either 25bps or 50bps, and there is little way of telling which way the Bank will leap on the day. On balance we opted to call only a 25 basis point reduction, but it was a close call. Certainly, we think the risk of a 50 basis point reduction is greater than the 15% chance or so that markets are currently pricing

RBNZ OCR preview: How low will it go?

Tuesday, July 21, 2015 12:07 AM UTC

Editor's Picks

- Market Data

Most Popular