After UK decides to exit from EU, euro’s vulnerability against majors still looks intact, euro against dollar and yen has just shown a negligible recovery from the recent lows, but the commodity currencies, such as CAD and AUD continued to claim their bulls streaks.

But the biggest possible support comes from on-going FOMC inaction and an energy-inspired rise in inflation that sees (German) pressure to start tapering the bond purchases increase.

The debate about how the ECB should respond to higher inflation is the single-biggest potential catalyst for euro strength in H2 2016 or H1 2017.

While, sterling seems ending its longest bearish streaks since 2009 after UK authorities lent some helping hand that cushion the economy as the country decides to exit from the EU. Sterling began rising against majors after Mr George Osborne (the chancellor of the Exchequer) floated a lower corporate tax, While BoE’s Carney hints the macro-prudential easing, so at the moment these two developments could provide the cushion sterling in near terms.

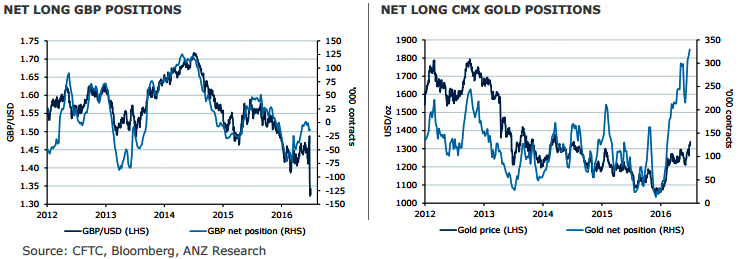

As a result, the net short GBP positions were reduced despite the sharp slump in sterling, by USD0.2bn to USD1.1bn, (see above graph). EUR saw the largest net buying during the week at USD2.4bn, which is at odds with the price action. This is the first time in six weeks that EUR has seen net buying.

Brexit volatility saw funds turning to safe haven assets like gold. Net long contracts in gold rose to 329,800 this week, the highest in CFTC data history (see above graph).

European banks are undergoing a real-life stress test in the wake of Britain's vote to leave the European Union.

For the banks, the implications aren’t yet encouraging. While increased capital requirements have bolstered lenders, Barclays Plc, Royal Bank of Scotland Group Plc and Lloyds Banking Group Plc saw their shares plummet after the June 23 referendum.

The UK central bank is in crisis-fighting mode, unleashing emergency liquidity to ensure lenders have access to cheap funds.

The Bank of England (BoE) has pumped £3.1bn worth of liquidity into the UK’s banking system, following the financial turmoil caused by the EU referendum vote.

Lenders bid for a record of £6.33bn of funds, but the BoE only filled £3.07bn worth of requests.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist