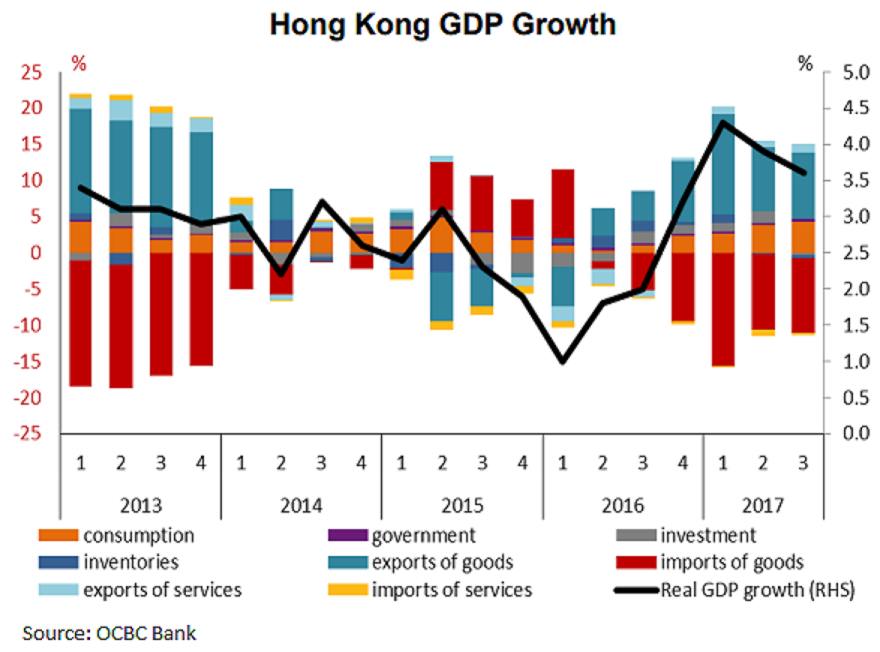

Hong Kong’s gross domestic product (GDP) is expected to expand by 2.9 percent y/y this year, according to a recent research report from OCBC Bank. As the low base effects faded, GDP growth peaked in Q1 2017 and slowed down gradually in the aftermath. However, the pace of deceleration has been much softer than was previously expected. The economy’s rosy performance was mainly driven by the global recovery, solid labor market and domestic fiscal stimulus.

The new government places great emphasis on the innovation and technology industry, in an effort to diversify HK’s economy. The proposed tax reduction for and the additional investment in the innovation and technology industry may boost the industry’s growth. Meanwhile, the government aims to promote innovation and technology development by participating in the development of the Greater Bay Area.

As China is also aiming to optimize the industrial structure according to the 13th Five-Year plan, Hong Kong’s strong research capability and the large talent pool is expected to facilitate its co-operation with Mainland China in terms of innovation and technology. This will in turn buoy growth of the Greater Bay Area.

"We expect external factors to continue supporting export of goods and tourism recovery. Tight labor market and fiscal stimulus will also keep private consumption as well as government spending and investment elevated respectively. Therefore, despite unfavorable base effect in Q4, we have revised our GDP growth forecast to 3.6 percent y/y for 2017. This will be the strongest growth since 2011. In the coming years, economic growth is likely to sustain albeit at a slower pace due to high base effect," the report added.

Meanwhile, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions