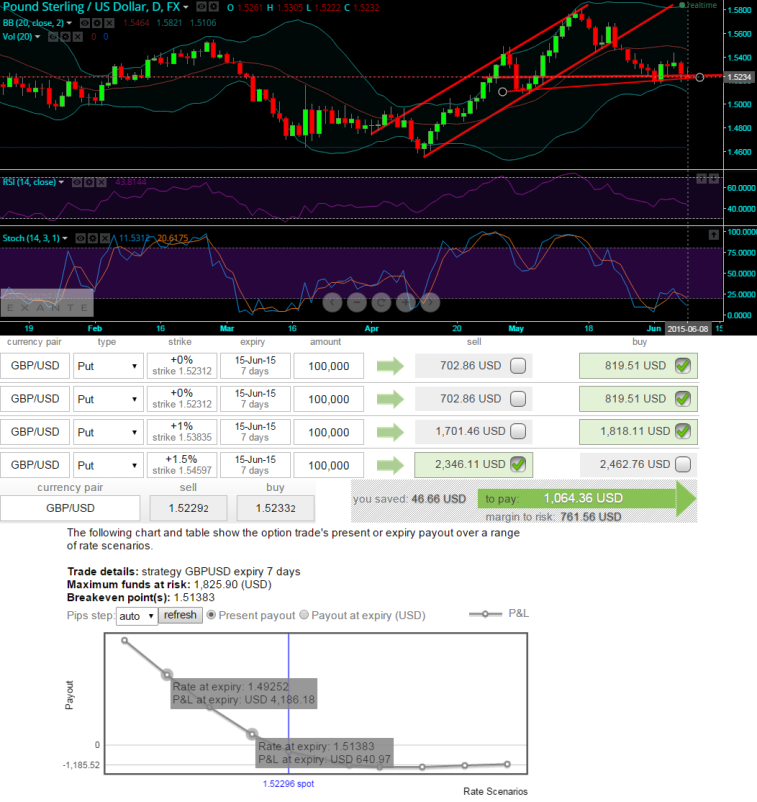

The head & shoulder pattern is traced out from daily charting pattern on this pair. We see right shoulder is struggling near neck line at 1.5238 levels. This level should be closely watched as any breach below neck line can drag steep decline and invite bears for their season.

RSI (14) converging currently at 49.0839 level towards downward momentum of price curve. While slow stochastic still signifies the overbought situation.

In last week, formation of a shooting star resembling candlestick followed by a bearish candle with long real body also occurred. Overall bearish sentiments are lingering around this pair.

Today's close would determine the next stage for whole week's trading direction. So, trades can be initiated as the pattern likely to complete today.

Hence, let's devise a trade plan upfront in order to spot optimal entry point so as to enhance the profitability.

The most common entry would be when break out of neck line occurs. Here, we anticipate any break below 1.5232 can be crucial point of entry.

Currency Option Strategy: Put ratio back-spread

Add more longs on mid month either ITM or ATM put and simultaneously short near month OTM put options as the pair remains tight to be in bearish actions on the underlying currency over the longer term but is quite neutral to mildly bearish in the near term.

Use 3:1 ratio while constructing the position as bearish sentiments are threatening bulls.

Head & shoulder pattern on GBP/USD; optimal entry point on PRBS

Monday, June 8, 2015 10:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate