TARGET 2 is large value payment system which is an interbank payment system for the real time processing of cross border transfers throughout European Union. TARGET 2 is a real time gross settlement system.

Target 2 imbalance remains at the heart of Greek crisis.

For example if a Greek importer buys from German exporter the payments will Channel via national central banks and European Central Bank. So Bundesbank will have a credit at European Central Bank (ECB) and Bank of Greece will have net debit at ECB.

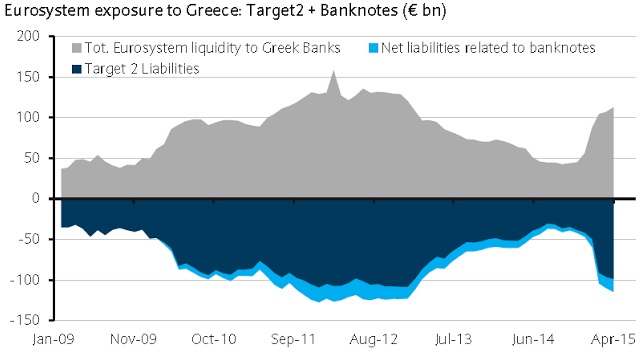

Since as of now there is no limit on TARGET 2 balance, at the peak of the crisis in 2011/12 Greek imbalance rose above € 100 billion.

However imbalance had fallen since then to less that € 35 billion by 2014 end, after which the imbalance again rose back towards € 100 billion.

The crisis in Greece has given the critiques chance to call for reforms in the system which might see tougher collateral rules in Future.

European assets including the Euro remains flat as Greek drama continues. Euro is currently trading at 1.12 against dollar.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings