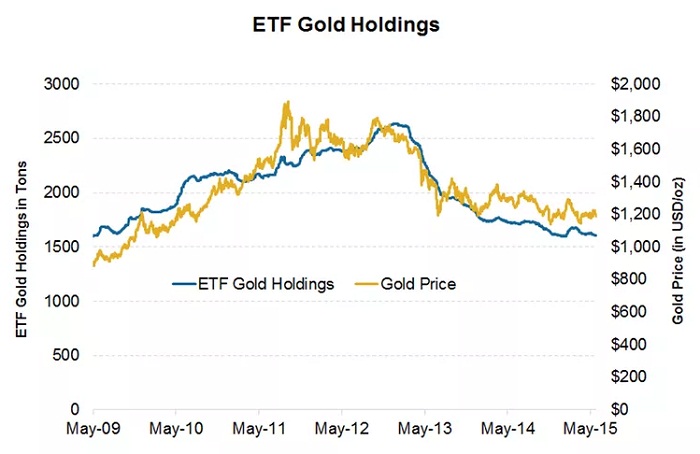

First quarter report from World Gold Council (WGC) after many quarters of outflow money flew back into Gold investment assets.

- However, only 9.2% of all the gold investment demand in first quarter of 2015. Outflow from ETF led to 30% drop in gold prices. The chart above shows while Gold is consolidating, ETF holdings have declined further.

As ETF sells gold, price might decline further. SPDR GOLD trust's holding has fallen close 700 tons, lowest on record.

Total gold ETF assets stand around 1600 tons, which is lowest since January. Holdings are looking to decline further, suggesting price drop.

Gold is currently trading at $1182, support lies at $1135, $1060 and resistance at $1224, $1310.

Gold is likely to remain under pressure as Dollar remains strong and central banks in Europe and Japan fends off global risk aversion.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings