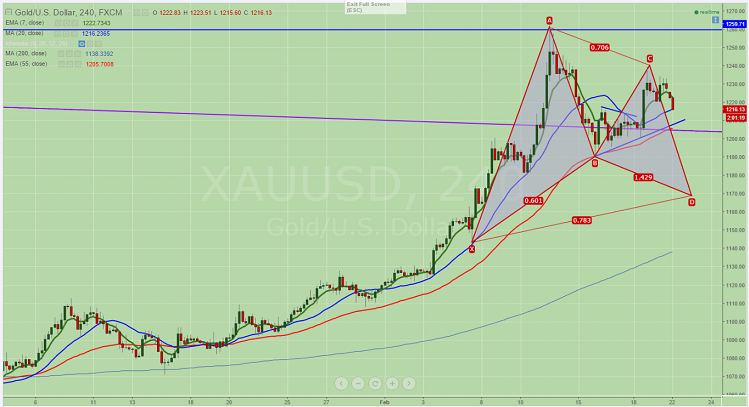

- Harmonic Pattern formed - Bullish Gartley

- Potential Reversal Zone (PRZ) - $1165

- Gold has retreated after making a high of $1239 (Feb 18th high) is currently trading around $1216. Short term trend is slightly bearish as long as resistance $1240 holds.

- On the higher side any break above $1240 will take the commodity till $1260/$1275.

- The minor support is around $1210 and break below targets $1198/$1180/$1165.

It is good to sell on rallies around $1220-$1225 with SL around $1240 for the TP of $1182/$1168