The U.S. Federal Reserve's rate hike showed confidence in the world's largest economy, but "spillover" effects from the hike could lead to tighter credit conditions and higher debt servicing costs for emerging markets. Companies that have loaded up on dollar-denominated debt are at particular risk, with increased chances of defaults. The IMF has calculated that emerging market companies have "over-borrowed" by $3 trillion in the last decade, reflecting a quadrupling of private sector debt between 2004 and 2014.

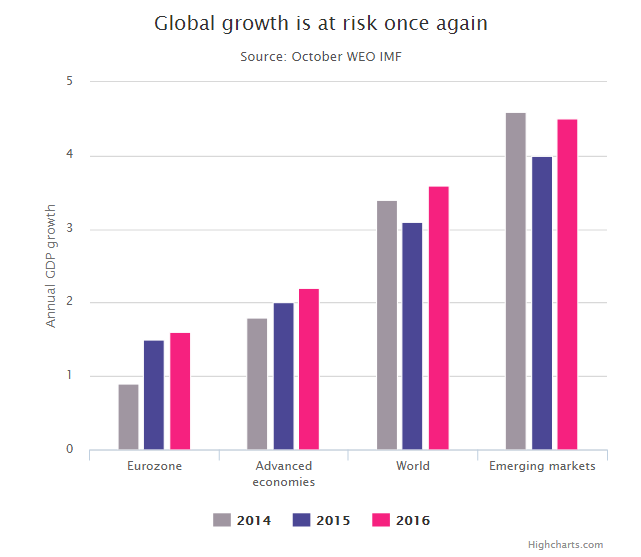

The Fund's financial stability report noted that any "failed normalisation" of interest rates and market conditions would wipe 3pct from the world's economic output over the next two years. The IMF had estimated the global economy will expand by 3.6pct next year, but with rising US interest rates, a Chinese slowdown and disappointing world trade prospects appear slim for major global economic pickup.

"The key question is whether the U.S. economy is finally robust enough not only to sustain its own recovery but also to lift world trade and global growth enough to allow the external deflationary pressures weighing on U.S. inflation to wane," outlined HSBC economists Janet Henry and James Pomeroy.

The IMF has urged both the European Central Bank and the Bank of Japan to continue their unprecedented quantitative easing policies and maintain record low interest rates in an uncertain global environment. Modest growth in developed economies is generating very little inflation and forcing central banks in keeping interest rates low. Moreover, the with scope for oil prices to fall below $30 a barrel in the early months of the year, inflation is likely to remain lower than any of the world's major central banks are anticipating. It will then become harder to raise interest rates if inflation continues to undershoot official forecasts.

Although many emerging market economies have enhanced their policy frameworks and resilience to external shocks, several key economies face substantial domestic imbalances and lower growth. Near-term economic growth looks stronger in advanced economies, compared with the recent past, but weaker in the emerging market and developing economies that account for a growing share of world output and growth. Downside risks to the world economy appear more pronounced than they did just a few months ago, noted IMF in its 'World Economics Outlook'.

Global economic recovery will continue to disappoint in 2016

Thursday, December 31, 2015 10:41 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary