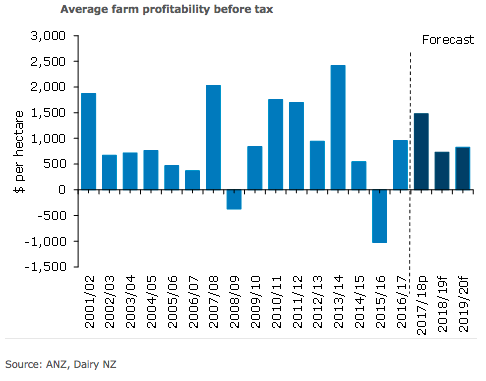

Dairy commodity prices have moved in a downward trajectory since the beginning of the 2018/19 season, putting pressure on returns at the farmgate level. A stubbornly strong NZD is also negatively affecting returns, according to the latest report from ANZ Research.

While higher commodity prices and a lower exchange rate are forecast to materialise before the end of the season, it is now unlikely these movements will come soon enough to support our previous milk price forecast.

"We have therefore revised our milk price forecast for the 2018/19 season to USD6.10/kg milk-solid(MS) (previously USD6.40)," the report commented.

The revised forecast assumes an improvement in dairy commodity prices in the second half of the season. Whole milk powder prices are forecast to average 6 percent higher than today’s prices across the remainder of the season.

In order to reach the lower end of Fonterra’s current USD6.25/kg MS forecast dairy, commodity prices would have to average 10 percent higher than current prices.

The NZD remains relatively strong against the USD. This in part reflects a shift in pricing for the RBNZ from rate cuts to hikes, an unwind of short positioning within the speculative community, and up until recently, an improvement in global risk appetites.

However, a slowdown in global economic growth, together with tightening global liquidity, is expected to put downward pressure on the NZD in time. Dairy company hedging means there is a delay in exchange rate movements flowing through to the milk price, the report added.

Therefore, any downwards movement in the currency will now have a greater influence on next season’s returns than the current season.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal