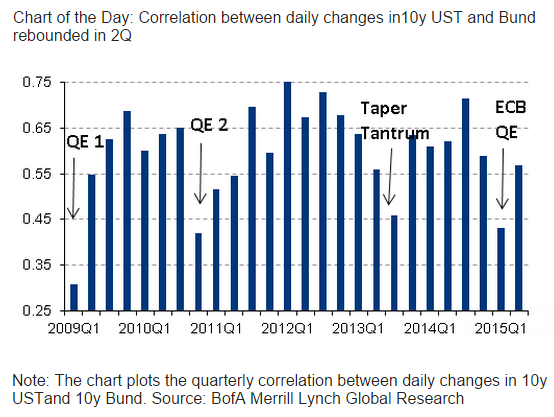

Global bond correlations have rebounded in 2Q as the market digested ECB QE. Historically USTs lead Bunds but since August 2014, we find that Bunds lead USTs. Weak global growth and inflation, and central bank easing should keep overseas government bond yields low, which would spill over to the US as well.

"We believe that Bund yields should decline in July with negative net supply, which should drag UST yields lower as well." estimates BofA Merrill Lynch

Global bond markets recouple in 2Q

Monday, June 22, 2015 5:17 PM UTC

Editor's Picks

- Market Data

Most Popular