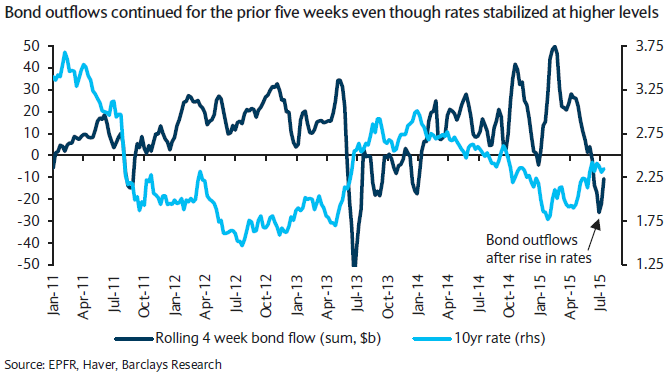

Even as bond yields stabilized at higher levels over the past two months, bond funds have had outflows in each of the prior five weeks; the pace of outflows did slow, however, with a modest inflow last week.

End investors were seemingly still focused on the spike in rates in April-May and were less concerned about the risks in Greece and China, says Barclays. The recent bout of risk aversion lacked the flight to quality that has characterized prior episodes.

Barclays notes the outflows have been fairly broad based, with Europe and high yield bond funds hit the hardest:

- Europe bond funds had outflows of $11.8bn the past six weeks; global bond funds had outflows of $9bn.

- US bond funds had inflows of $3.8bn last week, recouping half the prior outflows.

- High yield bonds had outflows of -$10.4bn in the past six weeks. Other segments also had sizeable outflows, led by IG corporate (-$3.6bn), municipals (-$2.5bn), and EM (-$2bn). Government bond funds also had sizeable outflows of -$4.5bn.