Yet another sign from China that inflation is strengthening its grip all around the world. The inflation has already picked up in the United States; now closer to the Federal Reserve’s long-term 2 percent target, which may prompt a faster rate hike in the United States. It is more critical in Europe, where inflation in Germany is close to 2 percent (target for the European Central Bank) but the central bank is still pursuing easy monetary policies.

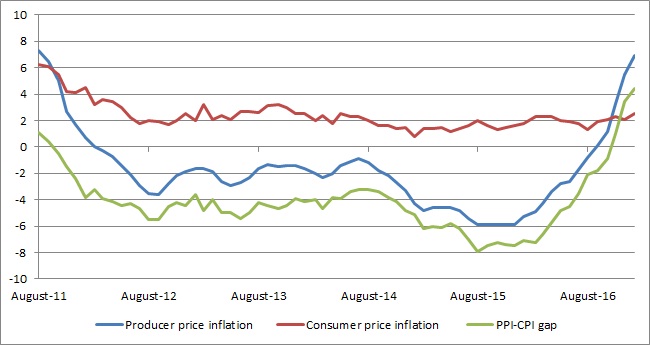

A report released from China today showed that inflation measured by both consumer price index and producer price index accelerated substantially in January. Consumer price index is up 2.5 percent in January, whereas producer price inflation rose to 6.9 percent y/y, which is the highest level since August 2011. 33 out of 40 industries tracked by the measure saw increases in prices. Main contributors were oil and gas extraction, coal extraction and washing, smelting, and processing of ferrous and non-ferrous metals, petroleum processing and chemicals and chemical goods production.

With the rise in inflation, the People’s Bank of China (PBoC) has already been changing its stance towards monetary policy. While the central bank induced record easing since the great recession of 2008, earlier this month, PBoC raised the 7-day Standing lending Facility (SLF) rates by 10 basis points to 3.35 percent.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX