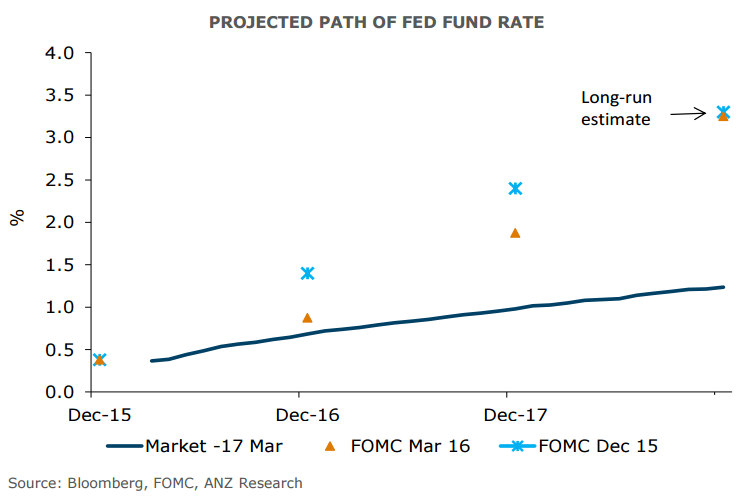

As widely expected, the US Federal Reserve kept interest rates unchanged at its March meeting on Wednesday and downgraded projections for this year. The Fed significantly lowered its estimate for the number of rate hikes in 2016, announcing rates will remain unchanged for at least another month. The FOMC cut the median expectation for the fed funds rate at the end of 2016 by 50bps to 0.9%. The fed funds rate is forecast to rise 100bps in 2017 and the longer run equilibrium rate was cut slightly to 3.3% from 3.5%.

In its statement, released at the end of its two-day March meeting, the Fed noted that inflation had picked up in recent months, but nonetheless is expected to remain low because of the declines in energy prices and the lagged effects of earlier dollar appreciation, which is weighing on non-energy import costs. FOMC sounded more optimistic about the outlook for growth than it did in January.

Yellen struck a cautious tone during the press conference, stressed that the Fed’s “policy is not on a pre-set course” and that projections made by the committee are not promises. Yellen also said that the rate could be reduced to zero in the event of any shock to the financial system. The Statement continues to reiterate that the Fed remains data dependent.

"We have taken out one of our three-25bp hikes forecast for the FFR in 2016 given the more cautious nature of Fed policy to global risk factors. We remain of the view that June is live for a rate rise, and is also when we expect the next hike. Another hike is pencilled in for Q4 2016," said ANZ Research in a note to clients.

Despite headwinds from oil, stocks and situation abroad, some parts of the U.S. economy continue to perform well. It’s notable that core CPI data surprised to the upside again in February, with price pressures looking reasonably broadly based. Services inflation (ex-energy) in the CPI is running at 3.1% y/y, the dollar’s DXY index is now negative in annual terms, and the oil price is showing increasing signs of stabilisation. However, the Fed's committee does not appear confident that inflation is gaining enough momentum. Meanwhile, the labour market remains firm, unemployment fell in January to 4.9% and the domestic-focused economy (eg services) has proven resilient with evidence emerging that the slowing in manufacturing is basing.

“Dr Yellen and her colleagues, in our view, are making the grave mistake of overweighting the importance of the manufacturing sector and the stock market. Dr Yellen and her colleagues are focusing on events outside the US simply because they can. The domestic data, as of right now, are not unduly alarming.” said Ian Shepherdson, chief economist at Pantheon Macroeconomics. He added that not raising interest rates this month is a "big mistake”.

U.S. markets reacted positively to Yellen's assessment. The Dow rose 125 points as she spoke. The downgrade to FOMC members’ projections for economic growth, inflation and interest rates provided a supportive backdrop for interest rate markets. Market interests drop markedly yesterday with 5yr US swap rates ending around 16bp lower at 1.285%. USD fell sharply against most currencies. On Thursday USD/JPY was trading at 111.30, EUR/USD was at 1.1325 and GBP/USD was at 1.4342 as of 1100 GMT.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand