Germany's final domestic demand grew strongly again in Q1 (0.8% q/q) reflecting robust consumer and investment activity. The latest surge in consumer spending is largely a result of the sharp fall in oil prices through January and associated gains in household purchasing power. Given that the oil price now appears to have broadly stabilized, its positive impact on other household spending should soon fade.

However, solid labour and housing markets are also supporting household spending and both remain in solid shape. In the wake of the introduction of a minimum wage, job creation slowed this year, especially for low-skilled professions but unemployment figures have continued to decline and the unemployment rate has fallen further, to 4.7% (ILO definition), the lowest among EU member states. Hourly wage growth, however, has remained in the 2-3% range. Wage growth in the industrial sector (excluding bonus payments) has eased somewhat, to 2.2% y/y, while wages in the service sector have strengthened a little lately on the back of the new minimum wage and public sector wages. The solid labour market, together with record-low interest rates and substantial net migration, has boosted demand for housing; construction activity rose significantly in Q1, also supported by benign weather.

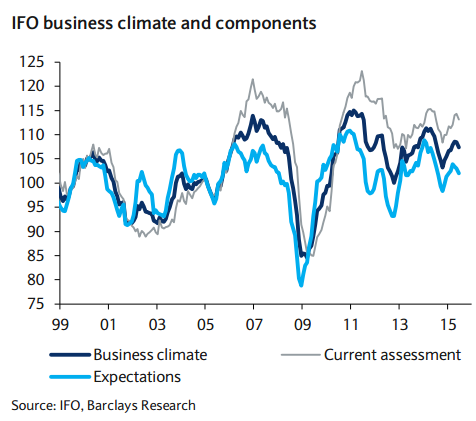

In addition to new construction, equipment investment has picked up and domestic factory orders for capital goods indicate that the better investment activity should last for the rest of this year. However, the latest PMI and IFO business surveys indicate that most firms remain cautious about the business outlook and although they are replacing ageing structures and equipment, they are still reluctant to add new capacity or pursue new business opportunities aggressively in Germany.

Germany’s domestic demand remains the key growth driver

Wednesday, July 22, 2015 10:24 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed