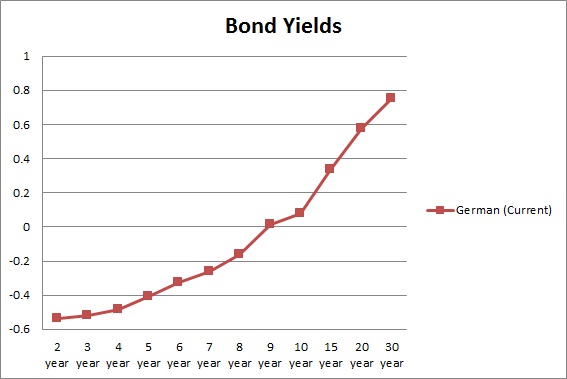

German average rate, which is called Umlaufrendite has dropped below zero, for the first time ever. The rate, which represents average rates across outstanding bonds, is published once a day by German Bundesbank.

At the end of last year, the average rate was around 0.5%, which was back below 0.2% by February and dropped to -0.02% yesterday. Lots of factors have contributed to the drop. First, it was early year crisis in China that reduced the rate by 30 basis points and more, then it was spill-over effects from Bank of Japan’s (BOJ) negative rates and then it was latest easing package from European Central bank.

The last leg was largely due to disappointment in U.S. payroll data and push back in rate hike expectations. Investors are bracing the possibility of monetary easing over a much longer horizon than anticipated six months back. Global concern over slowdown, fear over Brexit has also been fuelling the latest leg of the rally.

Germany so far hasn’t taken up the opportunity of lower borrowing cost much, however, many Euro Zone countries, such as France, Ireland have come out to issue longer-dated debt, sometimes 100 years to benefit from lower borrowing cost.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed