Today’s GDP figure that will be released at 8:30 GMT from the Office of National Statistics (ONS) unlikely to be a boost for the pound, simply because,

- The data represents second quarter figures and the Brexit referendum was held almost at the end of the quarter.

- In addition to that, much better than expected data has already come out from the United Kingdom and after some initial support they have failed to boost pound, which is struggling at 1.3 area.

Today’s release is the final estimate of second quarter GDP.

Past trends –

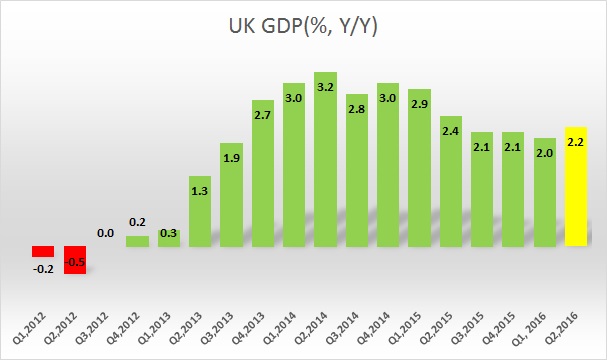

- After the 2008/09 crisis, the UK economy has been growing at the fastest pace among its OECD peers.

- GDP growth reached the highest level in the second quarter of 2014, reaching 3.2 percent growth on yearly basis. Since then growth has somewhat waned. In last quarter of last year, growth was 2.1 percent y/y, same as the third.

- This year, the economy grew 0.4 percent in the first quarter and flash estimate shows it to be growing by 0.6 percent in the second quarter on a quarterly basis.

Expectations today –

- Today, GDP growth is expected at 0.6 percent q/q and 2.2 percent y/y. The important thing to watch out would be whether the month of June, when the referendum was held made a difference or not.

Impact –

- The pound is currently trading at 1.296 against the dollar and we have forecasted, sterling will decline to 1.2 in the short to medium term and for such a trade the stop loss should be kept around 1.34 area.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals