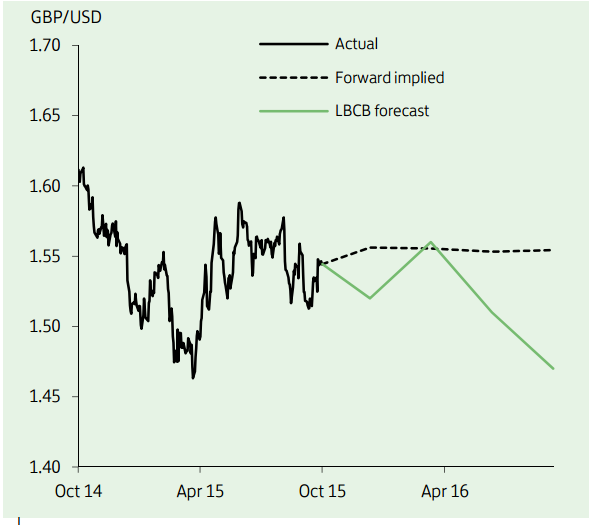

GBP/USD has traded in a four-point range around 1.55 since May and little reason seen for this to change over the coming months. Given the uncertainty over the prospects for monetary policy on both sides of the Atlantic, the inability of GBP/USD to make a decisive break in either direction is perhaps not surprising.

External pressures, particularly from slowing growth in China, have added to global deflationary and financial market volatility. Even if the US raises rates in December, slightly ahead of the UK, the pound should still find some support into early 2016. This is because an early rate rise in the UK would come as a bigger shock to the market, which is not expecting the first UK policy tightening until early 2017.

While the pound should receive a lift from a prospective rise in UK short-dated bond yields, there are formidable obstacles to the pound's sustained outperformance. Potential EU referendum risk, a still large current account deficit and more acute fiscal austerity should push sterling lower in H2 2016.

GBP/USD Outlook

Wednesday, October 21, 2015 9:10 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX