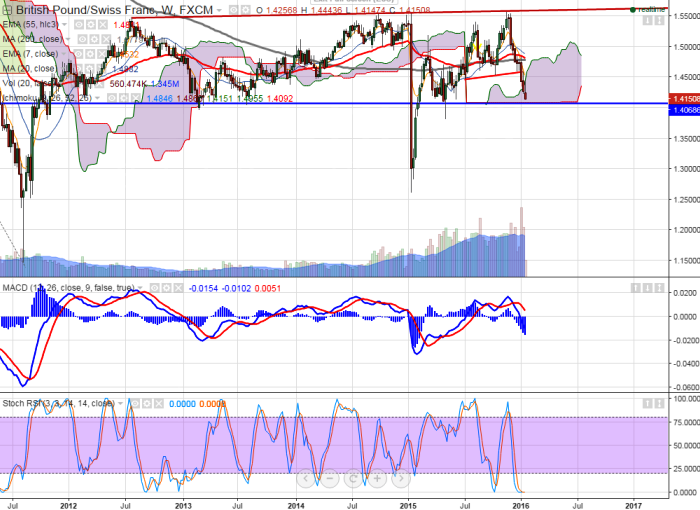

- GBP/CHF has reached 6 month low at 1.4147 and is currently trading around 1.4156.

- Pound Sterling declined against all major pairs on Tuesday after more dovish comments by BOE Governor Mark Carney.

- On the economic front UK inflation data released yesterday came better than expected and Pound sterling showed a slight jump but BOE Governor Comments on interest rate hike in University of London dragged the Pound sterling to 6 year low against USD.

- Mark Carney stated that BOE will start rising interest only when core CPI "notably nearer the 2% target". So this confirms that BOE will start increase interest rates only after 2017.

- Technically the pair has reached 1.4147 and major support is around 1.4079 (Cloud bottom).

- Any break below 1.4079 will drag the pair further down till 1.3800 level.

- On the higher side major resistance is around 1.4320 and break above targets 1.4397/1.4500 level.

- Momentum indicator StochRSI is in oversold zone and slight recovery till 1.4320 can be seen.

It is good to buy at dips around 1.4150 with SL around 1.4078 for the TP of 1.4260/1.4315.

FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level

FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: USD/ZAR dips below lower range, bearish bias increases

FxWirePro: USD/ZAR dips below lower range, bearish bias increases  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: AUD/USD jumps after RBA rate hike

FxWirePro: AUD/USD jumps after RBA rate hike  FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside

FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside  FxWirePro: USD/JPY builds momentum , eyes 157.00 level in the short term

FxWirePro: USD/JPY builds momentum , eyes 157.00 level in the short term  EURJPY Breaks Above 184 – Euro Bulls Charge Toward 187

EURJPY Breaks Above 184 – Euro Bulls Charge Toward 187  FxWirePro: NZD/USD consolidating around 0.6030 , bias is bullish

FxWirePro: NZD/USD consolidating around 0.6030 , bias is bullish  FxWirePro: EUR/AUD bearish as RBA hike boosts Australian dollar

FxWirePro: EUR/AUD bearish as RBA hike boosts Australian dollar  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  USD/CHF Breaks Out: Bullish Surge Past 0.7800 Fuels Fresh Upside Momentum

USD/CHF Breaks Out: Bullish Surge Past 0.7800 Fuels Fresh Upside Momentum  FxWirePro: EUR/AUD downside pressure builds, key support level in focus

FxWirePro: EUR/AUD downside pressure builds, key support level in focus  FxWirePro: GBP/NZD outlook weaker on renewed downside pressure

FxWirePro: GBP/NZD outlook weaker on renewed downside pressure