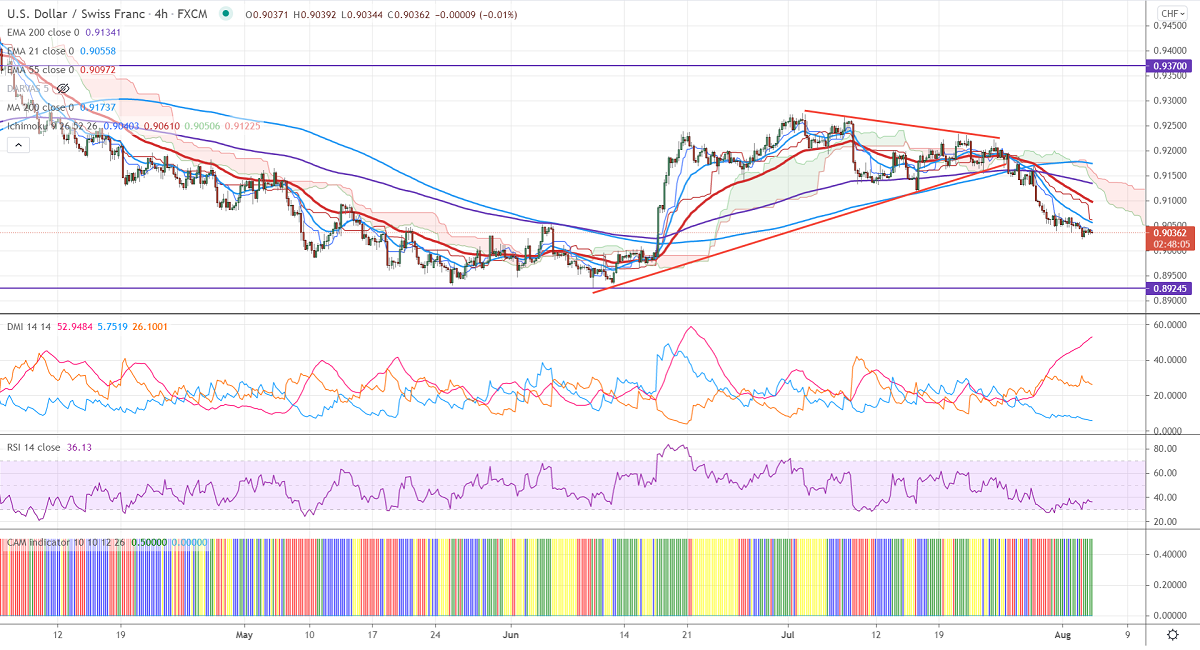

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.90403

Kijun-Sen- 0.90622

Previous week low– 0.90391

The pair breaks previous and hits a 7-week low amid risk aversion. The slow recovery in economic growth due to pandemics has increased demand for safe-haven assets like the Swiss franc. At the time of writing, USDCHF is hovering around 0.90369, up 0.01%.

The US dollar index is holding above 92 levels. It should cross the 92.20 level for intraday bullishness.

Markets eye US ADP and US ISM services PMI fr further direction.

.

Trend- Bearish

The near-term support is around 0.9020, any breach below confirms further weakness. A dip till 0.9000/0.8925. On the higher side, immediate resistance is around 0.9075 (200-day MA). Any convincing breach above targets 0.91150 (support turned into resistance)/ 0.9128/0.9150/0.9185.

.

Indicator (4 Hour chart)

CAM indicator – Bullish

Directional movement index –Bearish

It is good to sell on rallies around 0.9048-50 with SL around 0.908-5 for a TP of 0.8925.