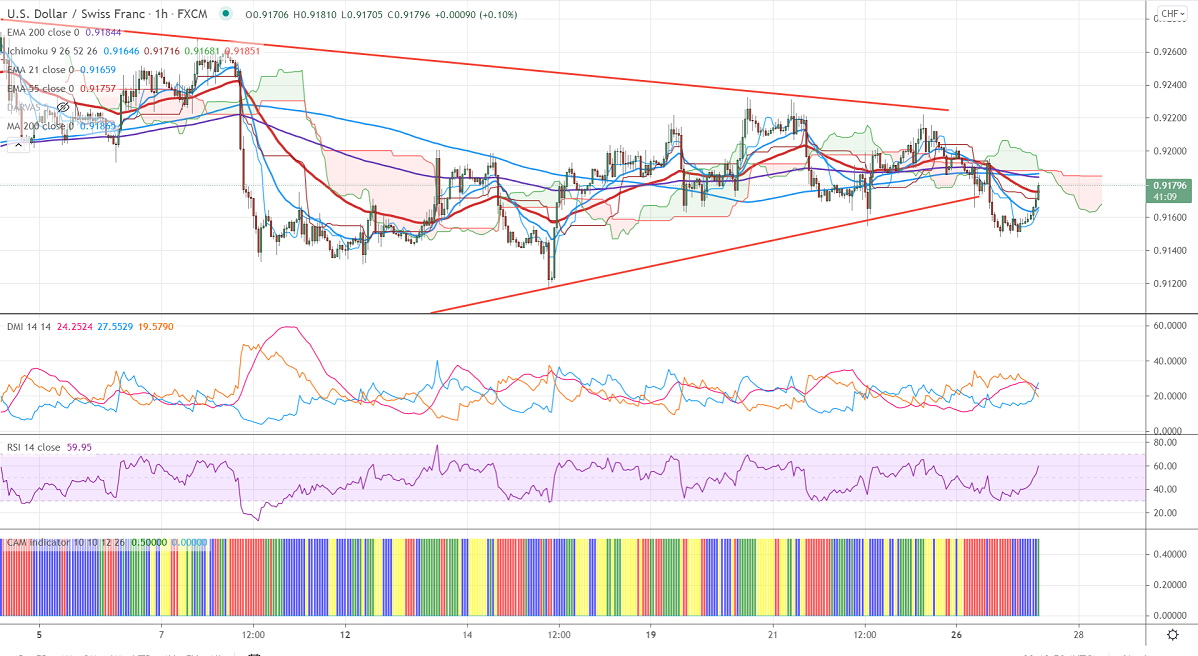

Ichimoku analysis (1-hour chart)

Tenken-Sen- 0.91617

Kijun-Sen- 0.91716

This week High– 0.92326

Previous week low- 0.91330

The pair has broken trend line support and holding below that level. The intraday trend is still neutral for the moment. The surge in the number of coronavirus in major countries has increased demand for safe-haven assets like the Swiss Franc, yen. Markets eye US durable goods order and CB consumer confidence for further direction.USDCHF hits an intraday high of 0.91800 and currently trading around 0.91793.

.

Trend- Neutral

The near-term support is around 0.9150, the breach below will take the pair to 0.9120/0.9059/0.9000. On the higher side, immediate resistance is around 0.92380. Any convincing breach above targets 0.92750/0.93000.

Indicator (1 Hour chart)

CAM indicator – Slightly Bullish

Directional movement index –Neutral

It is good to buy on dips around 0.9170 with SL around 0.9130 for a TP of 0.9270.