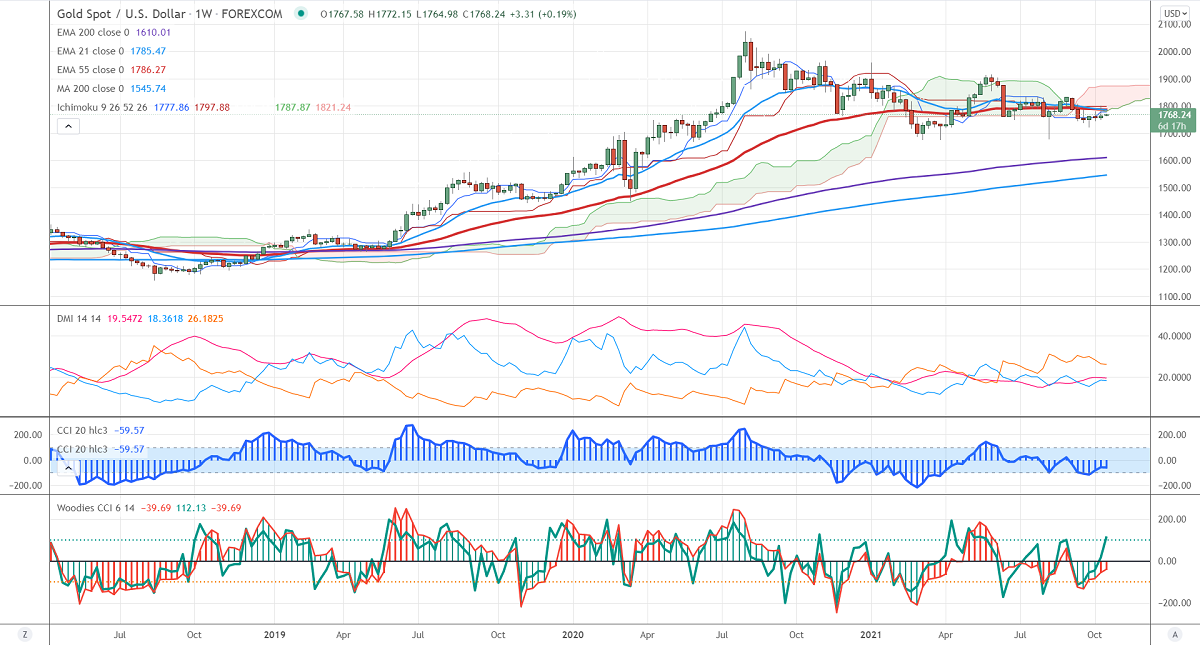

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1777.86

Kijun-Sen- $1797.88

Gold pared some of its gains made on Friday and lost more than $30 on upbeat market sentiment. The yellow metal surged despite positive US inflation data. The US dollar index has shown a minor pullback after taking support at 21-day EMA. Any surge past 94.50 confirms further bullishness. Gold hits a high of $1800.51 and is currently trading around $1766.82.

Economic data-

The US Inflation rose 4% in September and annual inflation rose 5.4% highest increase in 13 years. The Fed meeting minutes show that the central bank to taper bond buying by mid-November or mid-December this year.

Factors to watch for gold price action-

Global stock market- Slightly bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- bullish (bearish for gold)

Technical:

It is facing strong support at $1740 violation below targets $1720/$1700. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1800, any convincing break above will take the yellow metal $1825/$1835/$1860/$1900 is possible.

It is good to sell on rallies around $1785-86 with SL around $1800 for TP of $1720.