The main event today is the US Fed’s monetary policy meeting tonight. We expect rates to remain unchanged at 2.50% and the message from the Fed to remain the same (i.e. it can afford to be patient).

The FOMC will hold a press conference at the end of its two-day FOMC meeting for the first time even though no new economic projections have been publicized. Fed chair Jay Powell is likely to use today’s press conference to drive on the Fed’s new communication strategy and to divulge that in view of the comfortable inflation environment the Fed can afford to wait and see patiently how the global and domestic economy develops before taking its next decisive monetary policy decision.

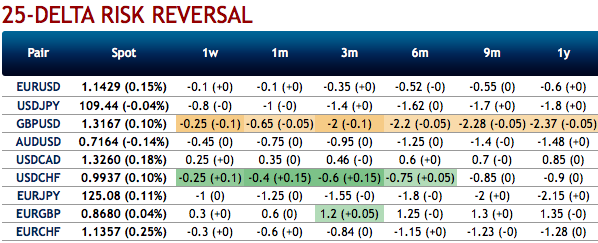

We witness fresh IV additions to USD among G10 FX space (refer above nutshell), while no considerable shift in risk reversals of dollar pair, except GBPUSD.

It is wise to be on top of market pinned risk as it indicates that such FX options strikes with large notional amounts, when close to the current spot level, can have a magnetic reflections on the underlying spot moves, which means spot may trend towards such strikes as the holders of the options will aggressively hedge the underlying delta.

We consider short correlation trades on USDCHF vs USDCAD as a way for playing the absence of tangible trends in the currency markets.

Weaker USD correlations intersect with tactically bullish GBP views most forcefully in long GBPJPY call options. Continue to run a GBPJPY vs USDJPY call spread switch; GBPAUD vs AUDUSD is also a viable alternative where there is more room for a correlation breakdown.

EURNOK downside, AUDUSD and USDCHF put spreads, USDCAD AED calls screen as the most attractive late-cycle opportunities via FX options. Courtesy: JPM & Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 68 levels (which is bullish), while hourly USD spot index was at 0 (absolutely neutral) while articulating (at 13:06 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different