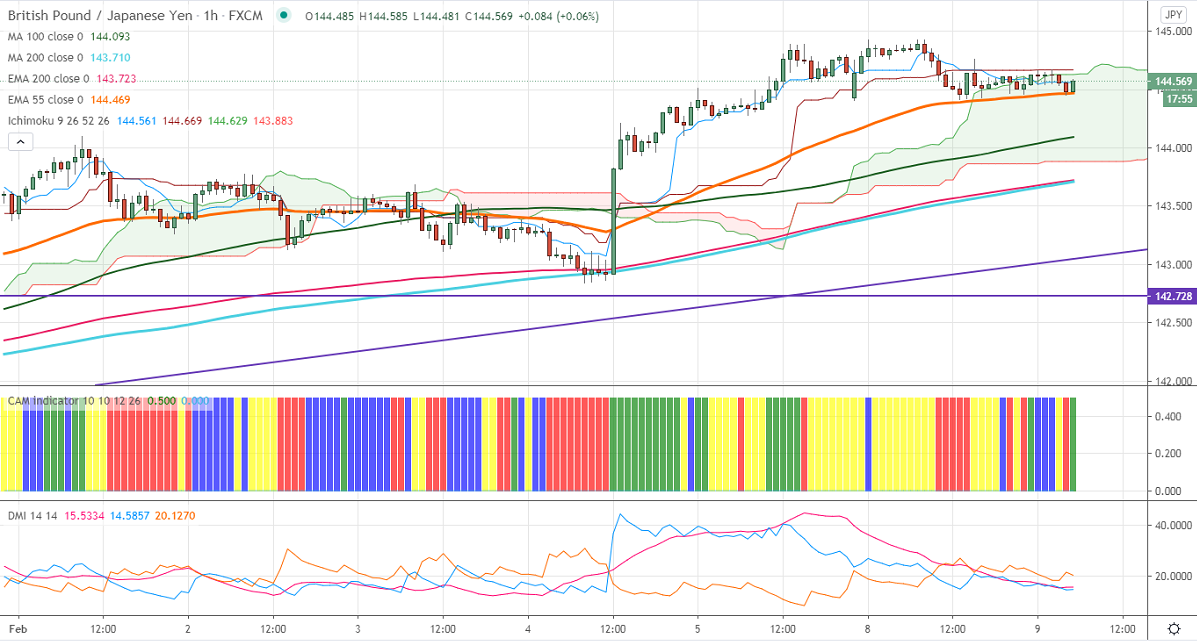

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 144.66

Kijun-Sen- 144.56

GBPJPY is consolidating in a narrow range after hitting 12 months high at 144.93. The surge in pound sterling against USD despite Brexit uncertainty and jump in UK coronavirus case. GBPUSD breaks significant resistance 1.3760 and hits the highest levels since Apr 2018. The slight recovery in yen is putting pressure on this pair at higher levels. USDJPY upside capped by 55- W EMA, any violation above targets 106.45.

Technical:

The pair's significant resistance at 145, any convincing break above targets 146.81/147.95. The decline from 156.60 will get completed at 123.99 once if it breaks 156.60. On the lower side, near term support is around 144.40, and any violation below targets 144.08/143.70/142.84/142.20/ 141.80/141.20.

Indicator (Hourly chart)

CAM indicator –Bullish

Directional movement index – Neutral

It is good to buy on dips around 144.10-15 with SL around 142.85 for the TP of 146.81.