• GBP/ NZD strengthened on Tuesday as better than expected UK jobs data lifted the pair.

• Britain's jobless rate hit a 48-year low in the first three months of 2022 and employers paid bigger bonuses to keep or attract staff.

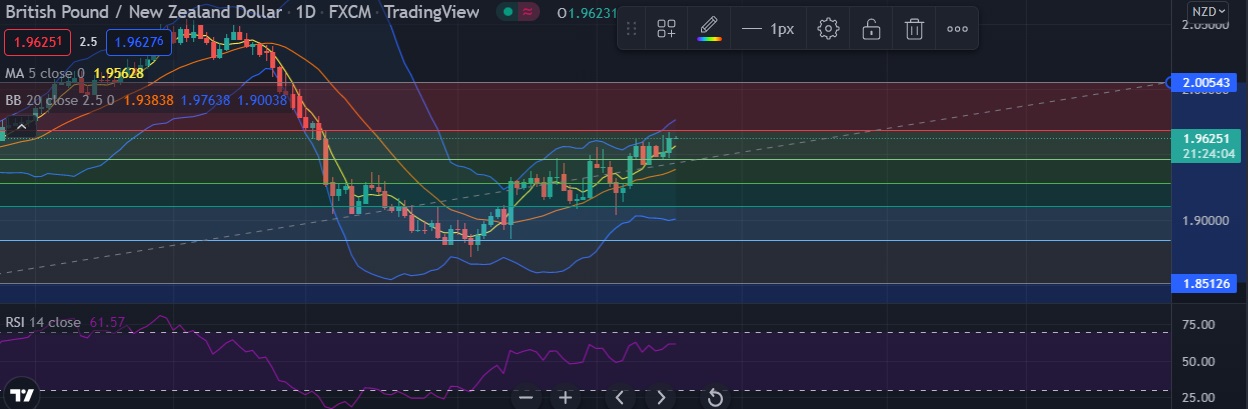

• The pair currently is approaching resistance at 1.9683 (23.6%fib). A break above will unmask 1.9750 level in the short term.

• Immediate resistance is located at 1.9683 (23.6%fib), any close above will push the pair towards 1.9750(Higher BB).

• Support is seen at 1.9557(5DMA) and break below could take the pair towards 1.9472 (38.2%fib).

Recommendation: Good to buy around 1. 9600, with stop loss of 1. 9500 and target price of 1. 9690