• GBP/AUD declined on Friday as Australian continued to benefit from higher commodity prices

• Dalian iron ore closed up 2.8% , LNG prices hit record high. Iron ore, LNG and coal are big export earners for Australia

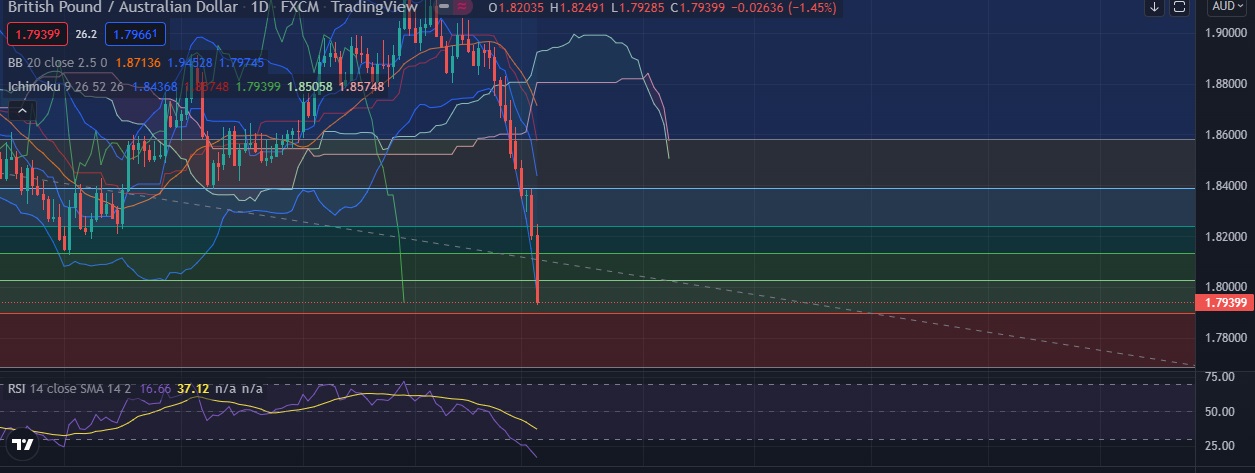

• The is pair heading towards 23.6% fib support, as near term direction of the pair is likely to be driven by current price action.

• Technical are bearish, daily RSI is negative at 16, daily momentum studies 9 and 10 DMAs are trending down.

• Immediate resistance is located at 1.8031(38.2% fib), any close above will push the pair towards 1.8133 (50% fib).

• Strong support is seen at 1.7933 (Daily low) and break below could take the pair towards 1.7893 (23.6% fib).

Recommendation: Good to sell on around 1.7960, with stop loss of 1.8040 and target price of 1.7820